EUR/usd

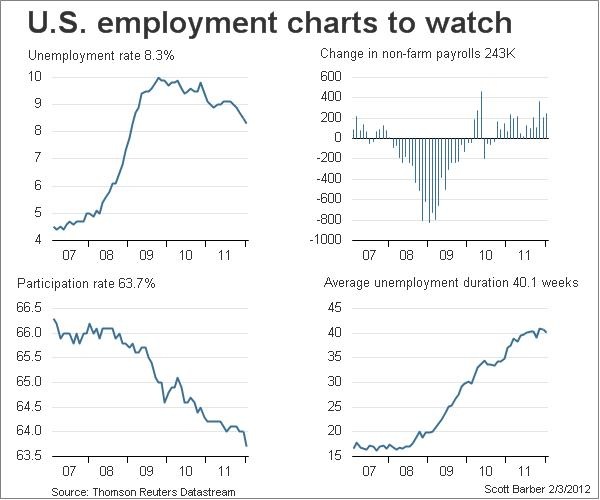

Quite naturally, Friday's report on the U.S. labour market proved positive for the markets. Stock markets experienced a rally, having grown by 1.2-1.6% to the end of the day. Actually, the labour market added 243K jobs in January. Besides, the corresponding figures for 2011 were also revised: BLS increased the number of employees in 2011 to 266K compared to what had been reported earlier. The unemployment rate fell to 8.3% from 8.5% in December. Considering unemployment, the economy is on the right track: in November 2010 the unemployment rate made 9.8%, after which there set in a steady tendency for its decline. To the optimists' regret, the growth of employment in the U.S. was only half due to the increase in the number of jobs. The rest was caused by the reduction of the economically active population. Its level in the U.S. is 63.7% now. At the peak of the recent rise the figure was 66.4%, but lately it has been actively declining due to the natural frustration of people over their employment prospects. The average duration of unemployment is still more than 40 weeks, though it has gone down a bit as people are leaving the workforce ranks. Despite the extension of the workweek and higher cost of the working hour, weekly earnings added only 2.5% with inflation at 3 % compared with January 2011. Thus, even the U.S. working population is suffering the real fall of living standards. Though let us once again emphasize that the report could turn out even worse. The U.S. dollar rose on the improved prospects for the monetary policy. Now economists are not that sure about the further QE by the Fed. Europe and the unemployment growth in the troubled countries, in contrast to the U.S., don't do the euro any good. Besides, today is an important day with regard to the negotiations over Greece. The coalition needs to approve further savings measures. The market got strained, selling the euro. The pair fell to 1.3080 against the 1.32 high on Friday. The fifth attempt to get above that mark turned into a failure. Won't the euro-bulls give in?

GBP/USD

Following the euro, the sterling stumbled on its way of strengthening against the dollar. From Friday's highs near 1.5860 it fell down to 1.5770 in the course of trading on Friday evening and Monday morning. However, this movement, despite its insignificance, seems to be the break of the upward trend. Yet whether it is really so or not will be clear at the end of the day, if the pair manages to stay below the support line the upward trend. Britain is not going to bring us any vital statistics today. As for the already published data, the Lloyds employment confidence rate is really striking. This index rose from -75 to -73 in January, but it goes in contrast with the June level of -50.

USD/JPY

The clearest reaction to the U.S. data publication was observed in the dollar/yen pair. Its growth was supported both by the dollar strengthening and the rise in the stock markets. As a result, the pair soared to 76.80 from Friday's lows near 76.10. The employment growth in the U.S. served as a good signal for the markets to get less enthusiastic about safe-havens and to look closely at risky assets. Most likely, USD/JPY will hold in this area for some time. Consolidation around this mark started as early as August.

AUD/USD

The Australian dollar rose on Friday, having rewritten the highs of September and late October. On the stock market growth the pair managed to rise to 1.0794. However, the euro correction today has caused a certain adjustment of the positions, so now the aussie is trading slightly above 1.07. Well, let us see for how long the Aussie-bulls will be able to fight – the one-and-a-half-month rally has already exhausted them.