EUR/usd

Yesterday's attempt of the euro to come off the four-month lows proved to be futile. The euro/dollar has been plying between 1.3585 and 1.36550 for over a week. The certain dissatisfaction with the US statistics, due to the poor employment data from ADP, could strengthen the single currency only for a while yesterday, taking it to the upper bound of the range. As reported by that company, the US private firms in May increased the number of jobs by 179K instead of the expected 217. The rates for the preceding two months were also revised down. The foreign trade data also didn't ease the situation, pointing at extension of trade balance up to 47.3bln, which is the highest level in the last two years. Since November 2013 we have seen a clear trend for extension of the trade deficit, which led this indicator away from the multiyear lows (which in their time spoke about success of rebalancing) to the average monthly rates since 2008. Of course, the rates from early 2004 till October 2008 were much worse, anyway the formed trend shows that the US production hasn't increased too much over the post-crisis time. With the recovery of the labour market Americans have been extending imports. And it is already little connected with the growth of commodity and energy prices. But let's turn back to today's agenda. The ECB is expected to cut the rates. Expected not only by economists and commentators, but also market participants. The swap market shows that creditors pay for the opportunity to lend the euro. Under such conditions the banks prefer to allocate funds in dollars, getting 25bp from the Fed instead of getting nothing (now) or paying 10-15bp for keeping cash in the ECB (expected). Despite the fact that the expectations have been mostly built into the rates, the rate cut and the course for the further easing by the ECB may continue putting pressure on the euro. Let's see what the ECB will venture to do and what draghi will say.

GBP/USD

The sterling is also trying to form the bottom. The suppositions about slowdown in the services sector after the slowdown in production and construction have been only half confirmed. The PMI's decrease was minimal, from 58.7 to 58.6 against the expected 58.3. Excited by this good news the cable grew from 1.6700 to 1.6770. By now trading is held close to the opening level of the preceding day, i.e. 1.6745. A day before trading opened there as well.

USD/JPY

The yen refuses to fall fast. Yesterday usdjpy bumped into 102.75 after which the correction sentiment became stronger. The Japanese officials are generally optimistic about the future, expecting a stronger uptrend. In particular Sato said today that the moderate recovery trend would begin since summer. Behind these words we should see unwillingness to extend the package of incentives. The dollar is now ¥102.50 worth.

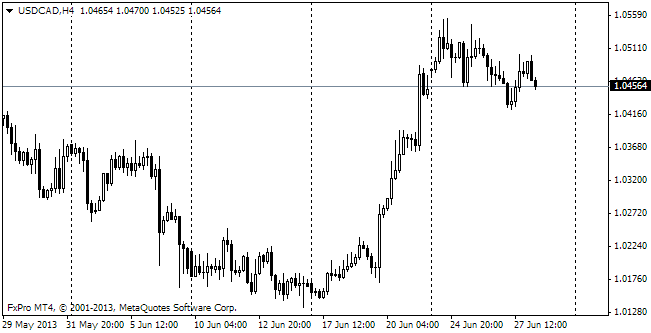

USD/CAD

Unlike the above-mentioned currencies, the Canadian Loonie keeps trending down. USDJPY grew to 1.0950 last night. Probably, bulls had decided to break through 1.10 already before the payrolls release. Though it should be mentioned that the pair still has a broader channel. Already about a month trading has been held between 1.0820 and 1.0940. Yesterday's and today's attempts to break higher look quite persistent, but now it is more likely that the rally of the beginning of the month will be followed by a rollback.