EUR/usd

Yesterday the euro-bulls didn't let the pair cancel out the growth of Wednesday. The pair was picked up on the dip to 1.2700 and was pushed off above 1.2800. It's absolutely unbelievable volatility in comparison with that mire, we observed last summer, when VIX reached the pre-crisis lows. Now it is at its three-year highs due to the impressive correction in the stock indices. It is that very profit-squeeze, we mentioned so often before. To be honest, we expected it much earlier, so now buyers' enthusiasm has significantly subsided after hitting 2000 in s&p500. Another, more direct, reason for the beginning of selling is the growing amount of data on the US economy, which make the steadiness of business and consumer activity growth rather doubtful. It is remarkable that the current situation with the pressure on indices arouses concerns among the Fed's officials. Yesterday afternoon the market was surprised by the comment of Bullard ( a famous hawk) that fomc probably wouldn't end the bond purchasing program in October, if decline of the stock exchanges bothered the Committee. This approach supported the markets and accordingly made the participants treat the dollar with greater caution. Otherwise, there would be nothing left for the markets to do, but focus on the quite favourable employment statistics of the USA. The weekly unemployment claims, published yesterday, unexpectedly showed a decrease by 23K to 264K. The lower rate was reported only once in 2000 and steadily below this level the claims were in the 1970s and earlier, but then the population size was much less. So, here the labour market feels perfectly, but probably this is a result of workforce passivity, when people simply prefer to retire instead of looking for a job. The Fed must be also trying to find out if it is so.

GBP/USD

Yesterday the cable tried to make up for the missed rally against the dollar a day ago. gbpusd threatened to go above 1.6100. Actually, it was stopped only by absence of active players in the markets as the weekly highs were tested between the active phase of the US and Asian trading sessions. Today is Friday, so the markets can be more cautious in their intentions and slightly move off the local weekly highs. The sterling will surely be happy to catch up growth in the stock exchanges, but if the latter go down it also can slightly depreciate, as money will actually flow from the US indices instead of the British ones.

USD/JPY

Let's venture to suppose that the short-term correction in the yen is over. If the situation in the stock exchanges doesn't deteriorate sharply, usdjpy can allude to the support, set at 105.50 on Wednesday and Thursday. The upward movement may become more intense, if bulls manage to send the pair above 106.70 against the current 106.20. Otherwise, if the downward movement goes below the support of 105.50, we will hardly evade a deeper correction in the pair.

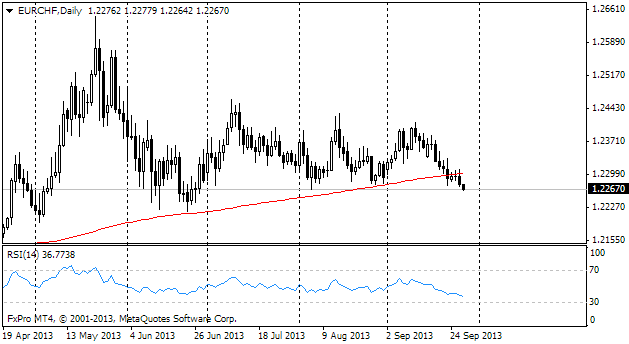

EUR/CHF

EURCHF is actively forming a support. The currency is purchased on dips to 1.2050, but there is a feeling that bulls are not strong enough. One of such reasons is demand for safe assets, which has grown due to the stock sales. But also take into account that since the beginning of this year the general trend in the pair remains downward. It is obvious that the SNB will find it more hard to remain in the sidelines in the near future because of the negative rates in the eurozone and the continuing decrease in inflation.