EURUSD

Trading activity went quiet not getting news releases alongside with Eater holidays in banks, main market players. EURUSD is keeping moving at 1.1150 since Thursday. Though, during this period we did not have any significant macroeconomic data release. We can stress only the GDP 4th quarter increase. Yearly growth of GDP (quarter dynamics multiplied by four) reached 1.4% against the expected 1.0%. The nice surprise should not be considered that big if we take into consideration that the increase has occurred due to reassessment of personal consumer spending. For the time being this did not make any impact for Forex market. Though we should keep in mind, currently there is a lack of participants on the market. Today we should pay attention to the fresh Spending indicators from the United States. February data of Personal spending and income will be published today, along with the Core PCE Price Index (the preferable inflation change measure by federal reserve).

Slow trades help to bring attention to British currency. pound is again in demand among those who chase underestimated assets. Today's rebound has brought the pair to 1.4170 – Thursday's highs – that looks quite good in comparison with volume's decline. From the technical analysis perspective the pair can climb up to 1.4180 and not having big obstacles. Nevertheless, it's a must to follow up carefully brexit surveys. Recent terrorist attacks may wake up in Britain population wish to fence themselves from the rest of the world.

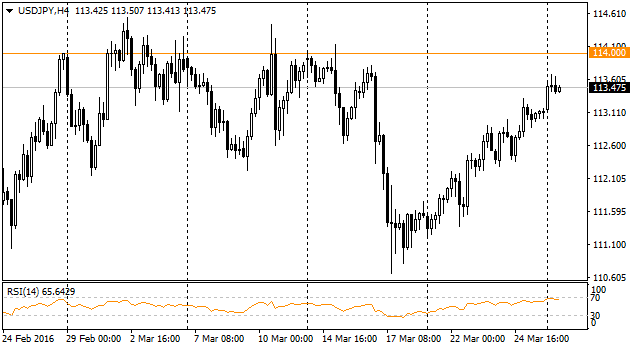

Strengthening of American currency is highly regular and it is enough for USDJPY raise in terms of missing other market drivers. During seven trading session in a row the pair is going higher reaching now 113.50. As we published earlier in a quiet market the pair recovery will be possible without any obstacles up to 114. Still we don't have any reasons to reconsider this assessment since the prior upper boundaries of the trading channel may again act as resistance levels in conditions of lack of main news releases and significant movements in the market. Published at night Household spending from Japan are important for fundamentally oriented traders, but it traditionally doesn't influence the pair a lot (during one hour after the release average movement is only 4 points). Retail sales have a bit stronger impact but still it is not enough to move the market – only 11 points of movement.

Canadian dollar lost its part during the second half of the week, while USDCAD gained 2.5 figures to the last week's lows and could not fix its positions below 1.3250. Traders, probably, decided to protect profits from declining at the beginning of the month, realizing they could build too high unrealistic expectations for loonie growth. Oil, the main driver of the currency, slowed down its raise. Obviously, players are trying to compare chances for different scenarios. In 2016, in comparison with the last year, oil added much faster 50% to the lows at the beginning of the year. Though, later on oil will experience difficulties in terms in growth, while oil production levels, as per received information, is becoming more and more contradictory. So, decrease in the US drilling units helps. Nevertheless, last week was released information disclosing gas production in current fields on close to January peaks. Inventory statistics is showing growth either, going higher and higher. Hence, we can suppose now that oil rally will stop and USDCAD will “form” its bottom in the area of 1.30.