The pair was fluctuating yesterday in the tight range of 40 points, but managed to come back to the starting levels by the end of the day. However, this can be considered as a small sign for changing of market sentiments since we have monitored the stable pair decline from the beginning of the week. As a whole we can admit that the pair has stabilized with the resistance level 1.1150 and has gained almost 70% after fomc comments last week and 38.2% from the total pair rally that happened during ECB and FRS decisions. Unemployment Claims from yesterday's release were one of the best among other indicators. It is increasing for the second week, though still remaining near to cyclical lows of the last 40 years. Last week's indicator was forecasted up to 267 k but it has changed a bit less – from 259 to 265 k. Claims results lower than these were indicated in last October, and much earlier – more than 40 years ago. Secondary unemployment claims are currently either on the long-term lows starting from 2000, with the exception of short-term period when it was lower in October 2015. Actual data with 2.179 million (that are delaying one week from the primary data) came back below 2.2 million. February Durable Goods Orders could not show the same optimistic results, though decline of the overall indicator was less than expected. It decreased by 2.8% in comparison with the last month's growth by 4.2%. The index that excludes vehicle orders lost 1.0% recovering almost totally January rise of 1.2%.

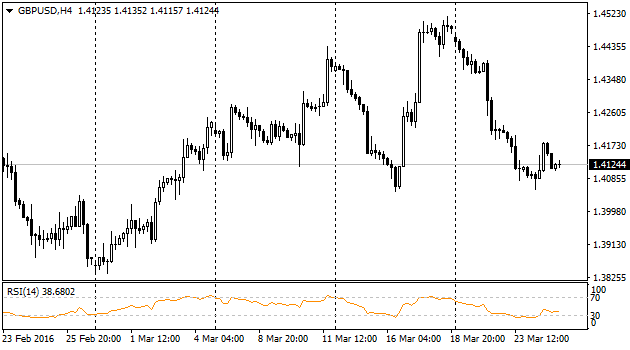

British retail sales lost in February 0.4%. But this decrease is rather strong after last month gain of 2.3%. British customers obviously are trying to return the taste of consumption but uncertainty of referendum naturally brings clouds to the clear sky of British economy. In the two last brexit surveys there is a shift of sentiments to the side of remaining as a part of the EU (43 % in the first survey and 46% in the second). Meanwhile, the part of respondents that was speaking up for exit has decreased (38% and 35%), so raising the percentage of undecided population. These data has not affected pound that positively as it could as the traders are awaiting British reaction to the terrorist attack in Brussels.

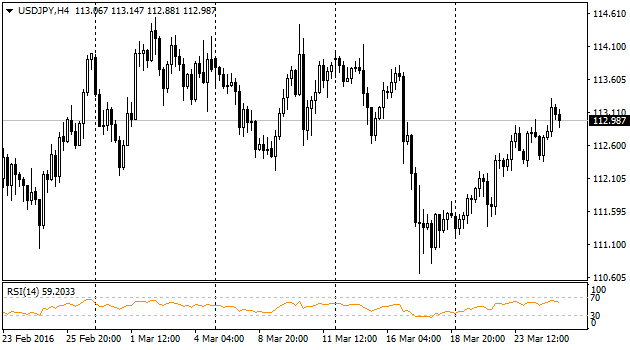

The pair is moving up the sixth day in a row. Today it was trying to break 113 level however still could not set up higher than that. Overall February index of Consumer Price Index reached the expectations at 0.3% year on year. But annual inflation pace in Tokyo in March was -0.1% in comparison with the last month 0.1% with the same expectations for both months. Coming in a month data reflecting the whole country's condition as well may bring unpleasant surprise regarding price movement. In the nearest future the pair approaching 114 may be under pressure.

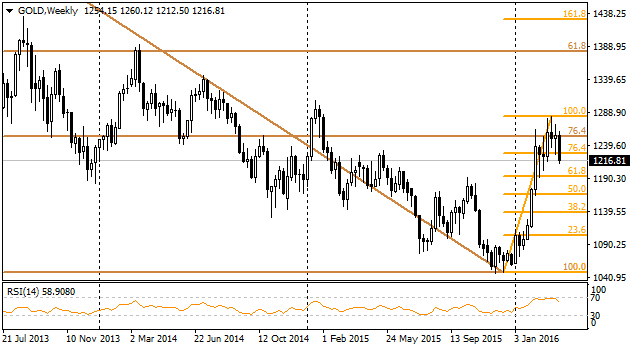

Gold is under pressure what is caused by usd growth and moderate demand for risky assets. When world inflation is low Gold is in demand if investors run from risky assets. In we follow technical analysis we can expect the price correction a bit lower that 1200 per ounce (61.8% of rally since middle of December by 1194). The decline lower can be considered as serious threat for the uptrend that was formed by the end of the last year. If last December rebound is considered as a part of the bigger downtrend wave, we would admit quite sad situation for gold. March highs might reflect the end of correction and identify the beginning of a new heavy decline impulse.