EUR/usd

Yesterday the US assets were again in demand. While stock exchanges were recouping the losses incurred at the end of the previous week, the US dollar was trying to partially offset the earlier losses. eurusd fell down to 1.3790 yesterday, but soon it found buyers, who brought it back above 1.3800. Those market forces once again disabled taking control over the dollar despite the strong inflation data. CPI grew to 1.5% y/y against the supposed 1.4% and 1.1% a month ago. It is also remarkable that the core indicator, that with food and energy excluded, also returned to 1.7%, which was lost two months ago. Though such growth rates don't threaten price stability and don't urge the Fed to take immediate measures to cool the economy, they are still signs of healthy demand growth, which is another argument for the Fed to change their plans regarding QE tapering and further increase of the interest rate. Germany, on the contrary, is showing more and more signs of skidding economic growth. The ZEW index, which is a good indicator of business sentiment, has fallen down to 43.2 in April, thus making it the fourth month of decline in a row and bringing the index back to the lowest level since last August. The release, anyway, didn't become a reason for selling of the single currency as the Current Situation Index continued to attack the highs, rising to 59.5, last seen in summer 2011. Yet, it should be taken into account that the Economic Sentiment Index and the Current Situation Index move almost in the antiphase and the latter reaches its cyclic highs approximately in a year after the core economic sentiment index hits its high. For EUR it was favourable that the index for the entire eurozone decreased less than expected. The clouds are gathering above the eurozone. The storm hasn't burst out yet, but it is only a question of a few months.

GBP/USD

The sterling suffered for no reason yesterday. bears were trying to push it down since the very morning, basing on the poor sales statistics from BRC, which reported a sales decrease by 1.7% y/y. The bears managed to find sell-orders and break the bank right at the time of the release. gbpusd was pushed down to 1.6658 on the news, after which the markets regained prudence and the cable was brought back above 1.6700. It is not about the pound's current overrating, the price statistics simply proved to be neutral. Behind the consumer inflation data, which met the expectations, market participants discerned higher producer prices indicators, both input and output. Even if the sterling needs a reason to decline, yesterday it was hard to find it. Probably, we'll find it today, on the release of employment data.

USD/JPY

The growth of stock exchanges helps the pair appreciate. After a continuous consolidation bulls decided to attack higher levels, bringing the pair above 102.20. Last week's highs are close to 104 and probably they are exactly the levels, where bulls and bears will launch their major fight. Until then the pair's performance is likely to be affected by the behaviour of the Asian and US stock markets.

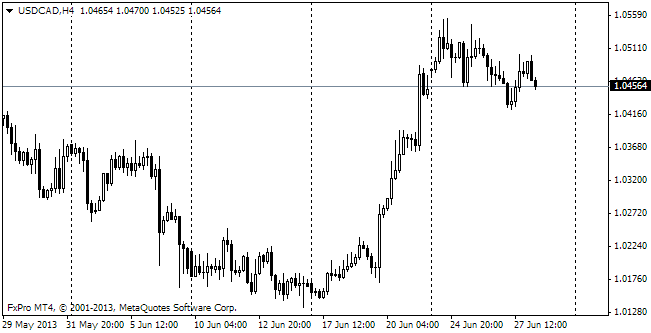

USD/CAD

Today the BOC will announce its interest rate decision. As has become a tradition in the recent years, the markets can consider only the situation assessment and promises of future economic steps, as neither policy toughening nor new incentives can be expected. Anyway, lately the country's domestic data have been quite contradictory and the Loonie's rate against the dollar is far from extremums. It means that the Canadian dollar runs the risk to be very volatile right after the release of the commentary.