EUR/usd

On Monday the single currency was under a moderate pressure, caused by draghi's promise to ease the policy not only in case of weak inflation, but also if the euro remains expensive. It's quite logical as growth of the rate ensures inflation slowdown in the future and it happens with a certain lag, leaving space for maneuver. The most important thing is to use it in good time. Anyway, the euro remains under pressure. Governor of the Bank of France Noyer said yesterday that the ECB is ready for easing if inflation stays low for too long. Such statements from the ECB's important officials significantly level a tougher tone, which we heard last week from the members of the ‘core' countries. In the meantime, it catches the eye that last week the euro was purchased more eagerly than sold this week. eurusd has depreciated by about a figure from its high, being a bit above 1.3800, but the last week was opened below 1.3700, so much should be done to convince players in the formation of an opposite trend. Probably, strong US statistics will be of help here. For example, yesterday there was a release of retail sales data, which reported growth by 1.1% in March. It's important that the core indicator, i.e. excluding automobile and service station sales, showed growth by 1.0% after the growth by 0.4% a month ago. Such rates speak about strong demand among Americans, which can further support consumption. This positive news also helped stock exchanges to break a chain of drops. Also it should be realized that the geopolitical risks are still strong and the claims of the ECB's members can be compensated by others, the opposite ones, as it was last week.

GBP/USD

Despite the fact that for the most part the pressure upon the euro can be attributed to the claims of the ECB's officials, the pound was also depreciating yesterday. For a while it was even trading below 1.67, which is a big drop after the high of 1.6820 hit in the second half of the previous week. But here the cable got support from easing in the stock exchanges. The high correlation with the latter helped the British currency pull back to 1.6740. Yet, now the main difficulty is to hold out here. In our opinion, it is quite a trivial task, especially in view of the release of the British and US CPI later today

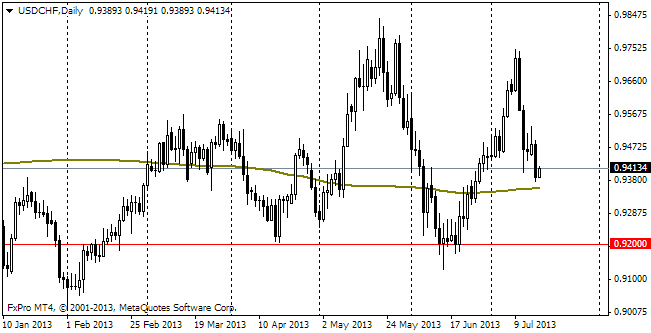

USD/CHF

The pair is picked up after the impressive selling last week. Now trading is held close to 0.88 and a week ago we were a figure and a half higher. Long-term investors can be bothered by a downward trend in the pair, however for those who prefer short-term trading (and such are many) the present moment offers nice prospects of trading on a pullback.

AUD/USD

The aussie got stuck a bit below 0.9400. The current situation looks quite favourable for selling of audusd, as the growth momentum has exhausted itself and the pair will need a correction after the impressive rally. In the heat of selling we will be able to see decline of the Aussie below 0.9000 in a week or so.