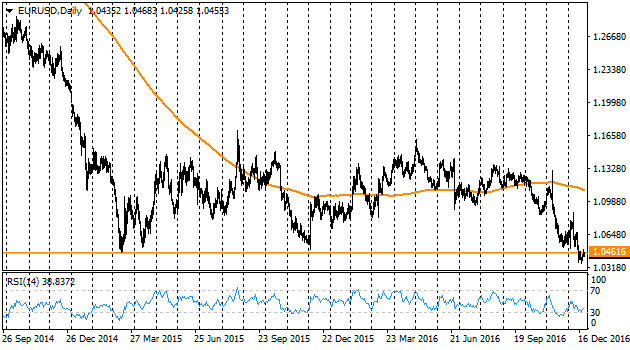

Last week was promising to be quite calm. Finally, this happened but at the beginning of the week, Euro renewed 13-year lows against dollar, having touched 1.0351. However, bears did not have enough power later on to accelerate the attack, and EURUSD returned to 1.0450 mark where it started the next-to-last week of the year. In the beginning, the main driver was a positive attitude for risks demand, but the cautiousness of players prevailed by the end of the week which encouraged growth of the common currency. At some point, bulls even tried to push the pair up to 1.0500 but 4H candle chart shows well the movement vector directed flatly right. Being below 1.0460 level, EUR/USD is remaining lower than lows of March 2015, which is the strong bearish signal for the beginning of a new year. Probably, micro task for the bulls will be not to allow year closing below this mark. There is no much time for this, as the nearest calendar is full of holidays. Among news releases from the last week, it is worthy to mention quite high Germany index of economic sentiment from Ifo, and the move to the positive side of a yearly inflation of import prices and producers' prices. The economic activity is obviously starting to increase, as they realized the prices would continue growing along with the world interest rates. The US GDP IIIQ estimation was again improved – this time up to annualized rate of 3.5%. Meanwhile, IV Q data – personal income and expenditures in November – has not meet forecasts that is bringing hesitations of GDP growth rate acceleration in IVQ.

GBPUSD

The British pound was far away from EURO's calmness. Las week sterling was losing its positions with the pace it gained at the very beginning of the month. Stock markets rally grabbed Britain as well. FTSE reached the areas of yearly highs, but it happened mostly due to weakness of the British currency. Now the pair is at 1.2280 mark and, probably, the bears' target until the end of the year will be 1.2150 level – October consolidation area.

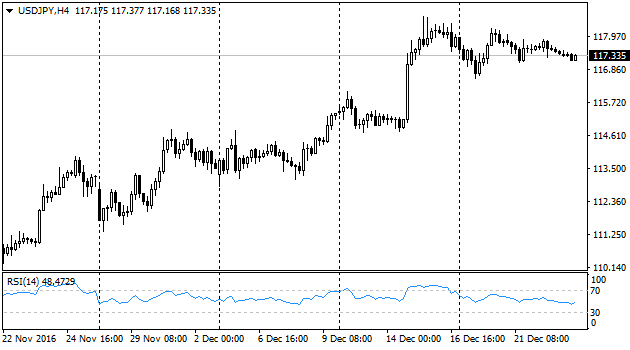

The Japanese yen has spent the week rather cautiously. Bulls, who managed to earn well at the end of the year, were fixing profits gradually. At the same time, there is no reason for a massive correction and all the basic preconditions are remaining the same: low rates in Japan are making carry-trade quite attractive in the nearest future while the potential of rate's raising in the USA is improving the dollar's perspectives.

The canadian dollar is living its own life, getting away from oil. When the latest is growing or staying on the spot, USDCAD is gaining powerfully the second week in a row, having returned to the area of February highs – above 1.35. It is easy to see on big charts that the pair is moving inside the moderate rising channel, reversed on its support level due to decision and comments of the Fed in the middle of December. The nearest target for the movement upwards is the resistance of this channel, which is now close to 1.37.