EUR/usd

Judging by the newspaper headlines of the beginning of the week, it looks as though the situation had come under control of draghi since Germans have become more yielding in regard to the issue of common bonds. Since then the markets haven't seen any significant details on this. Most of the markets have been trading sideways, each time fearfully bouncing off the highs. But the euro has been methodically giving up its positions after Wednesday's highs. Basically, diversity in the performance of currencies with equal reaction to risk demand is not a frequent case. Very often, this doesn't last for long with one direction finally stepping in the forefront. In our case, it seems as if the negative concerning the euro has managed to outweigh the neutral and positive sentiments in other markets. The markets are again in correction after the third attempt to reach the level of 1400 in S&P. In the meantime the single currency dropped already below 1.23 yesterday. The daily low in the pair made 1.2266 though the day began with a move up to 1.2386. From the technical point of view, EUR/USD has by now approached the lower boundary of the upward channel and has good potential to go further up. But the bad thing here is that it all largely depends on politicians' decisions, which can be analyzed neither from the technical nor from the fundamental perspective. Fundamentally the EU economy is weak, and the euro decline failed to make up for the business slowdown on the concerns about the eurozone integrity. These fears are getting more and more real as the business sector takes decisions with the actual probability of the EU disintegration in mind. Even Americans worry about this. But they derive at least some benefit from the growing market concerns, that is decrease in commodity prices. Due to this the trade deficit, just as we supposed, proved to be the lowest in the recent year and a half, making 42.9bln. Yet, Forex traders hardly managed to take advantage of this news, it produced absolutely no volatility in the markets.

GBP/USD

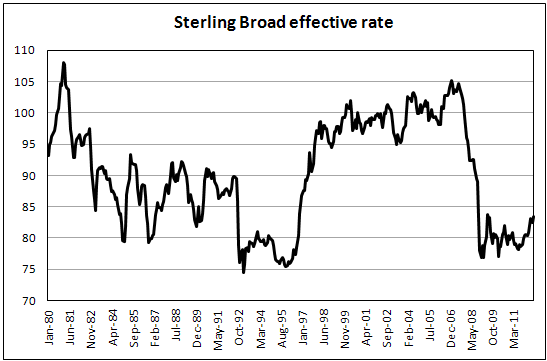

Unlike the States, Britain doesn't receive any benefits from the EU issues. Against the officials' expectations, the trade balance deficit keeps extending. The visible trade balance turned out to be the worst on record. The deficit made £10.12bln. The worst figure before this was recorded in September 2011 and made 10.25. However, the accumulated deficit for January – June 2012 proved to be worse than in April-September 2011. The situation is horrible and keeps aggravating. It is pretty plain that the BoE needs to increase lending in the country and also fight for competitiveness of the labour market and production by means of a lower exchange rate. Though against the broad trade-weighted basket the sterling isn't very high, rebalancing requires more. It needs the currency's depreciation.

USD/JPY

The dollar/yen is still within the channel. Though again we see that this channel has a slightly upward slope angle. The Thursday high was at 78.79 against the previous peak of 78.76. In fact, the difference is very small and can be neglected. Once again the yen buyers livened up above 78.70. In the last survey by TANKAN the corporations claimed to look to the average exchange rate of USD/JPY at 78. Adding to this increase in exports over the recent months and the need to spend money on the recovery after the earthquake and tsunami, we'll get the picture where the yen is in demand not only among those who care about safety of their money, but also among local corporations.

AUD/USD

The aussie is giving in. In the absence of favourable macroeconomic news the bears are gaining the upper hand. AUD/USD has dropped from 1.058 down to 1.051 over the recent hours, which is the lowest level since August 3. The fall was caused by poor statistics on China's trade balance. In July the surplus made 25.1bln against 31.7bln a month before and 31.5bln over the same period a year ago. The Chinese exports have grown just by 1.0% y/y and this means that imports will also set out for lower rates in the future. Now imports demonstrate a 4.7% growth annually.