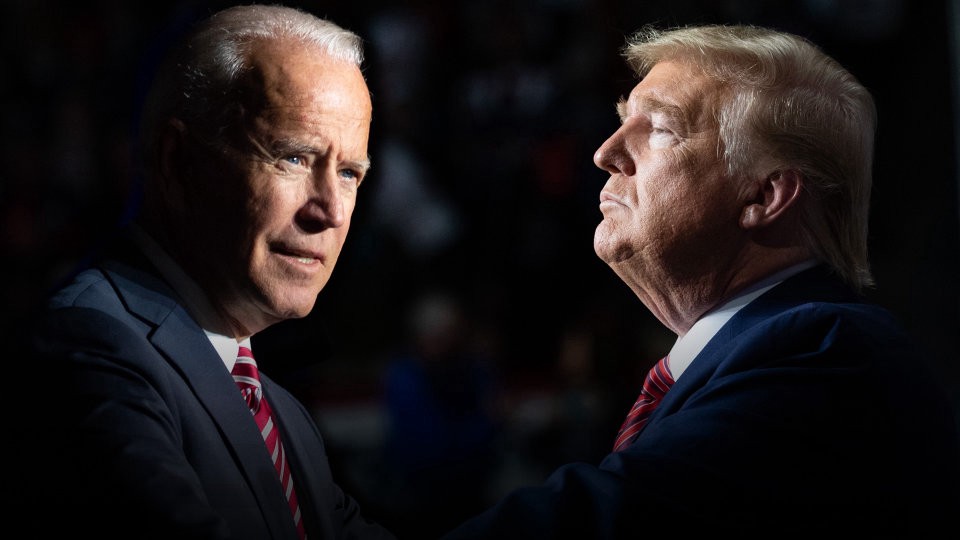

The 2020 US election has amplified an almost unprecedented level of uncertainty in the financial markets.

With a global pandemic, a healthcare crisis, and a weakening usd, you can be sure that the candidates are running against a backdrop of market volatility. And their policy decisions will create significant movements across a wide spectrum of sectors, should they win.

So how do traders prepare during these volatile times leading up to the 2020 US election?

The short answer is they position themselves to benefit from the market movements they predict may be coming up ahead, regardless of whether the market will move up or down.

Here are a couple of ways to do that.

Selecting a short term vs. long term strategy

Analysts see high volatility as generally good for traders in the long term. So, selecting a long-term strategy pays off in more volatile markets.

Long term trading benefits from higher market volatility, so traders who open long-term trades profit when volatility increases. Higher volatility also plays well for long-volatility-traders. That's because buying a stock or currency exchange rate costs money to maintain over time. So, if you are buying a direction and volatility doesn't increase, you will most likely lose money in the long term.

But don't write off short-term traders either. Just make sure you know that less or more risk is introduced into your position if you're a short-term trader, depending on whether you are long or short on volatility.

So when you're crafting your winning trading strategy, remember:

- Volatility is good for long term traders who can speculate in the markets

- Volatility is only good for short term traders who are longing volatility

Looking at the markets before vs. after the election

There are opportunities in the months leading up to the US elections and others after the vote-count, each offering their own trading strategies.

Before

When an election is announced, the country's currency is affected. A party or candidate can be considered either bearish or bullish for the country's currency, which impacts the markets.

Many analysts agree that a Biden win could weaken the USD, and both analysts and pollsters predict a Biden win. So if that happens, it may mean a slide for the greenback, an almost certain rollback on trump's massive corporate tax cut (negative for stocks).

After

Who will win, and how the markets will perform after he has won is what every trader wants to know these days.

Especially because Biden and Trump have very different policies for managing a wide spectrum of sectors, there will likely be significant movements in the markets, leading up to and after the elections.

Analysts predict that a Biden victory will bring on higher taxes that could spell trouble for Wall Street. Trump's reelection may cause an unexpected equity pitfall. A second-term presidency for Trump could also mean an escalation in US/China trade wars, and that could have a negative effect on commodities that analysts predict could take a dive after the elections.

Assessing these factors allows traders to find the right opportunities to benefit from the market's volatility with an informed strategy. And remember in volatile markets, things change quickly. So make sure to equip yourself with smart risk management strategies too.

Provided by Axiory Global