EUR/usd

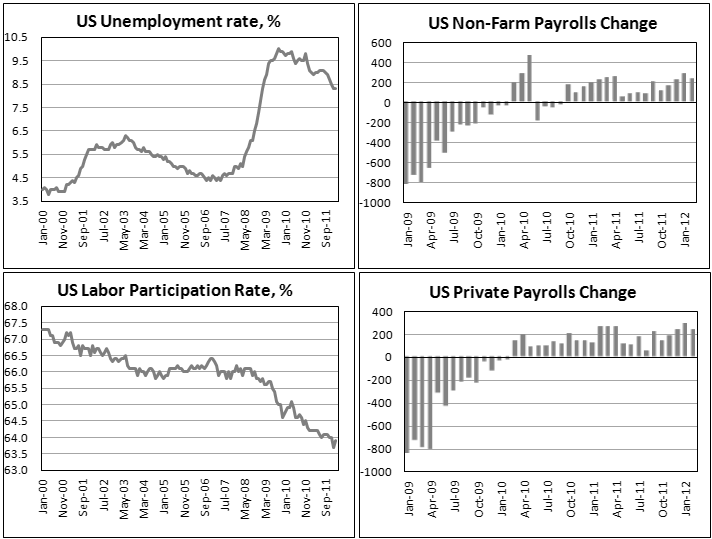

EUR/USD has been falling since Friday and has lost almost two big figures over this time. The single currency is now worth $1.3080, which is a four-week low. Against our expectations the market did not wait for the publication of statistics on the US employment to start selling risky assets, including the euro. As a result, at the time the non-farm payrolls were released, the euro was already trading as high as 1.3125. The labour market statistics has come in almost as good as expected, showing the 227K increase in the number of jobs (we predicted 235K, while the general market forecast was 206K). Moreover, it can't but be noticed that almost all sectors can boast improvement now. Employment in manufacturing has been steadily growing for three consecutive months, having added 31K in February after 28K in December and 52K in January. Private sector employment has been averaging out at above 200K over the last six months and grew by 227K in February. The unemployment rate remains at 8.3%, however the disappointing data of January, when the index went down only due to the participation rate reduction, have been a little bit smoothed away. This figure made 63.9% in February against 63.7% in January and 64.2% a year ago. These positive data make the Fed's extension of its QE programme less possible. But despite the obvious positive data context such expectations triggered the decline in stock markets and reduced the demand for risk. Turning to today, Europeans are expected to back another aid tranche for Greece, which will help the country to avoid a disorderly default. This is also good news, but over recently it's been too often the case that the market has fallen on the positive news. Technical analysts assume that the common currency will shortly drop below 1.29 on the rising bearish sentiment. However, there is a feeling that the market will be allowed some rest after a strong movement on Friday.

GBP/USD

Friday was an eventful day not only for the U.S. and Europe. Britain also brought us a batch of important news. However, it didn't boost any optimism in the market. Industrial production did not surpass the expectations, having lost 0.4% against the previous month and 3.8% against the previous year. As for prices, the figures, on the contrary, proved to be higher than expected, which reflects the existence of a higher inflation pressure on manufacturers. Input PPI increased by 2.1% in February, while in February 2011 the increase made 7.3%. This means that in the coming months it will be extremely difficult for manufacturers to keep the selling prices at the same level. Despite the strenuous efforts of the government and the Central Bank and despite the weak growth, prices are rising rather rapidly. If the current situation was accompanied by economic slowdown, it would be called stagflation. However, according to NIESR data, GDP has gained 0.2% over the last three months, including February. Though hardly noticeably, it is still growing.

USD/JPY

The yen was also affected by Friday's demand for the dollar. The currency experienced heavy sales and closed the day at 82.60. Today we can observe a small correction of Friday's movement on the decline in the Asian stock markets. Currently USD/JPY is trading near 82.25. It thus has reached its 11-month high, which is sure to be favoured by the Japanese politicians. However, there are very few reasons for being optimistic. The country's trade surplus more and more often yields to deficit. The Japanese companies sit on the sacks of cash and unpack them only to build factories overseas, where labour is cheaper, or closer to the major market outlets. Under such circumstances Japan badly needs to increase its marketability. This easiest way to do that is to depreciate the national currency, since the technological advances dwindle rapidly.

AUD/USD

The market sales and risk aversion didn't leave the Australian dollar unaffected. The aussie fell down to 1.0530, thus testing this area for the second time over the four trading days. This time the bears have got better chances, since risk aversion is observed in several markets at once. In addition, the Aussie is negatively affected by movements in gold, which is again suffering today after a vain attempt to recover.