Yesterday the pair got the blow as a result of the terrorist attack and obviously low economic indices. In spite of the fact that Ifo indicator was better than expected and reached 106.7 level, its movement looks more like rebound from the last month lows rather than real trend turn. Meanwhile, German Manufacturing PMI decreased from 50.5 to 50.4 and could not reach the forecasted of 50.9. The same French index has fallen below 50 for the first time since last August, appearing now at 49.6 though predicted level was 50.2. Economic sentiment as well could not show investors delight for euro. This indicator has improved less than expected up to 4.3 instead of 6.3. Current situation's review has worsened followed by index decline from 50.7 to 52.3. Objectively, the setback of all mentioned indicators is not very significant. So we cannot identify risks of economic decline in Euro zone. Even though low performance of macroeconomic indicators should pressure Euro and cause loosening of monetary policy for the longer period. Comparison with healthy data coming from the United States may stimulate the opinion of divergence between these central banks.

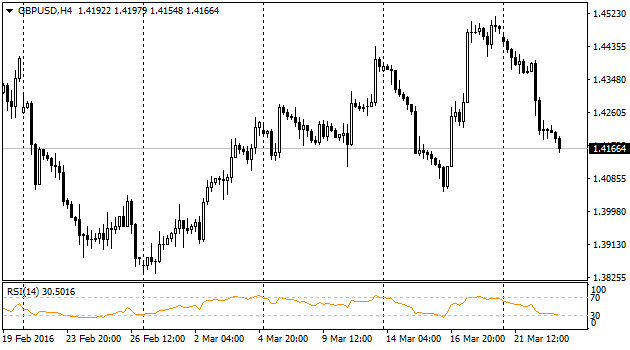

pound is again in tension caused by one of the brexit surveys held in the country. ICM has reported that 43% of respondents supported Brexit, while only 41% were against. As many government officials stand for keeping the country in the union, many investors are choosing to leave British assets. Cable lost almost 2 figures from the levels of yesterday's highs. Currently the pair is traded near to 1.4180, though it started the week at 1.4460 and had chances to be fixed at 1.45 last Friday. Weak pound as well was enforced by more slow inflation than was expected by economists. CPI increased by 0.2% against the forecasted 0.4%. Purchasing prices of producers decreased to -8.1% in comparison to previous month -8.0% and to expectations of -7.5%.

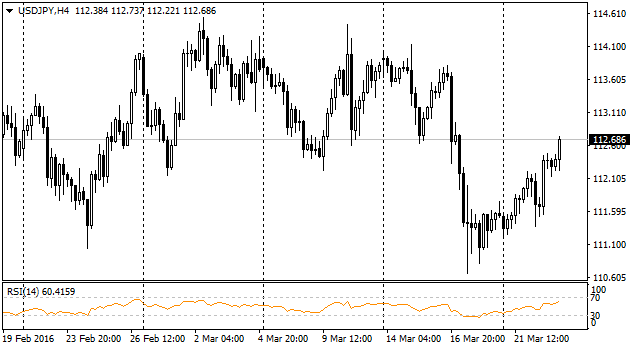

USDJPY

Yesterday the pair was under pressure when explosion news from Brussels came. Nevertheless, demand on it returned in several hours. The market was closed eventually near to 112.30 which is one-figure higher than intraday lows. Today we witness the rising of the pair (yen retreat) while pair is traded around 112.5. To wide extent such movement is correlated with the stock markets where we can see the recovery after big drop during first two months of the year. At the same time USDJPY has still pass a long way to reach the area of 120 where it was at the beginning of the year. There are still doubts, though, that in the short-tem perspective the pair will be able to go higher 144 level which presents the resistance area of trading channel of the end of February and beginning of March.

Australian aussie is traded quite inertly during the day, stuck on the levels around 0.7600. Good news from the country has made Westpac to change its forecast for interest rate decrease by Reserve Bank of Australia. Though almost immediately the released news showed more disappointing data. Trend indicator of vacant jobs intensifies its decline showing decrease in February by 0 .9% after drop in January by 0.4%. Some pressure on Aussie is caused by gold decline that lowered below 1250 in spite of terrorist attacks in Brussels.