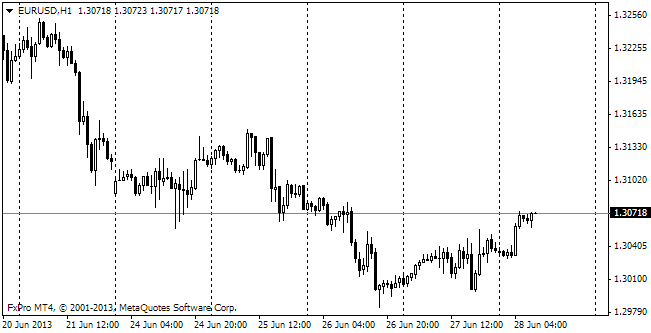

EUR/usd

The upward move, which we described in our Friday's review, was just the beginning of the drama that developed further. The single currency didn't have a single black candlestick till 13 GMT, closing positive all the time. As expected under such conditions, the following upsurges were stronger than the preceding ones. The pair got exhausted already at 1.3891. By then it had already made 70 pips in one direction and almost 30pips in the opposite one over 15 minutes. Technically, these are the highest levels since late 2011. And from a strictly technical point of view, Friday's move opens the way to 1.40 or even to 1.4250 (the preceding extremum). However, there is a feeling that such Pre-New Year movements should be disregarded. Similar abnormalities were in late 2008, when profit-taking after the euro's fall spurred growth from 1.25 to 1.47. The market soon returned to the old levels. But bulls resumed their pressure on the dollar in a while. If Friday's move is really a sign of the market's will to move up, it means that growth of the single currency contradicts the consensus forecast of the leading market analysts. The majority, we included, stake that the difference in the economic growth rates and the corresponding monetary policy will help the euro's depreciation (due to the expected easing by the ECB) and the dollar's appreciation (due to the further cut of QE3). The alternative scenario, that is the downtrend in the dollar, looks less probable in the coming days. The only noteworthy news today is a release of Pending Home Sales stats. Affected by the price growth, this index has been falling for the last five months and in October it was by 2.2% lower than a year before. As we see in other indicators, generally this coolness doesn't have any negative effect on the market– construction and sales stay quite high.

GBP/USD

The pound has also performed impressively. As a result, it is now trading near the upper bound of the trading range since 2011. The intraday losses against the euro have been recouped. Since 2009 the sterling has felt quite unsteady at such levels and has always reversed soon after breaking through 1.67. This time it would be better to stay cautious as if the euro follows the alternative scenario, the pound won't evade growth either.

USD/JPY

The yen has done its part, falling to the round mark of 105 against the dollar, 145 against the euro and 170 against the pound (the level of 175 remained unconquered with a reversal occurring just 8 pips from the mark). Further it is quite possible that the yen's depreciation will stall. As you remember, we stake on the moderate growth with pullbacks and corrections as opposed to what we observed a year ago. So, the bears' first target on their return from the holidays is to close the gap of 104.30-104.70 after Christmas.

AUD/USD

The aussie is still unable to stop its depreciation. Now it has returned to the yearly lows against the US dollar. Trading is held at 0.8840. Here the markets' passion for round figures (in this case 0.90) has failed to outweigh the negative sentiment in regard to the Australian currency.