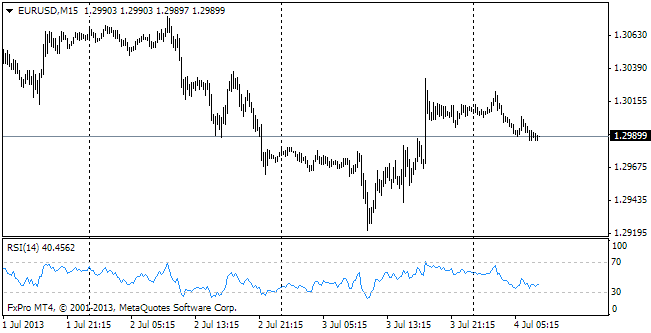

EUR/usd

Yesterday's hopes for a quick attack of dollar bulls failed. Though we were right in our forecasts regarding ZEW, the single currency didn't manage to break through 1.3500 and during the Asian session today the pair grew to 1.3580, thus exceeding the daily high of Tuesday. As you remember, yesterday we supposed that Germany's business sentiment would weaken, against the general expectations of growth. The actual data showed decline from 62 to 61.7 instead of growth to 64.0. Strictly speaking, the figures are not bad, at least they are not too poor so that the euro ram 1.3500. So, this event has been put off until later. We still believe that breaking through this level and further decline is just a matter of time, more so of the nearest one. However, neither Europe nor the USA release any important news today, so, most likely, we'll have to wait. The market needs big news, which will be able to break the trend. Probably, it will be Prelim PMI for the eurozone on Thursday. In this case today we may see continuation of slack consolidation at 1.3550. In short term it is even possible to outline an upward channel with the support at the intraday lows of Monday and Tuesday. Now it is passing through 1.3520. The upper bound of the considered channel is now at 1.3575, but since we are moving off this upper bound, the next movement will probably be to the support level.

GBP/USD

It is an important day for the British currency. We expect a fresh release of employment statistics. In general, analysts criticize the BOE for too pessimistic expectations in this regard. So, strong statistics may strengthen anticipation of changes in the rhetoric. Analysts suppose that the labour market will keep the same rate of unemployment decrease as has been observed for the last half-year. Employment has been showing good results for quite long, so it is likely that changes in views of the Bank's policymakers will be already recorded in today's meeting minutes. Public finances are also worth noting. On average days this indicator has medium influence on the markets, but today it is likely to be pushed into the background by more important publications. We'll hazard a guess that just like in case with the USA there was some hitch with the recovery, and the labour market stumbled in December.

USD/JPY

The yen still can't find sellers. Since the BOJ's two-day meeting didn't result in any vital changes in the policy, the Japanese currency has grown against USD. It is noteworthy that usdjpy has felt quite comfortable in the range between 104.00 and 105.00 in the recent weeks. Of course, this range was broken in both directions, but it was soon followed by the return to the neutral levels. It is remarkable that the yen is moving generally under the influence of technical factors, almost ignoring the statistics.

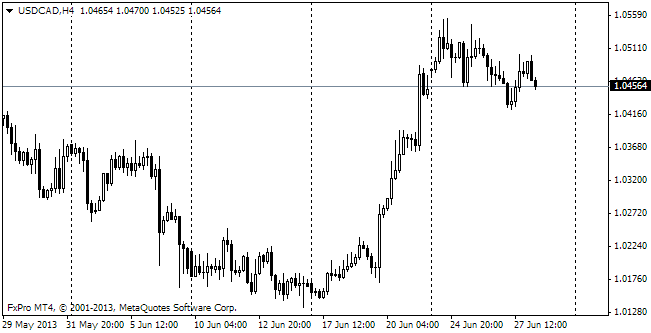

USD/CAD

The curse of commodity currencies befell the canadian dollar yesterday. usdcad exceeded 1.10. The high was at 1.1017, though since then the pair has pulled back to 1.0950. It seems that the pair is losing momentum after the impressive growth at the beginning of the year. If yesterday's growth is a peak, most likely, there will be a pullback to 1.0850. However, we shouldn't hurry with that.