EUR/usd

Quite naturally the single currency was suffering losses in the second half of the previous week. It was a result of the Fed's decision to cut the monthly purchases by $10bln to 75bln. Eventually, eurusd fell from 1.3810 to 1.3620. It seems that at that level players were purchasing the single currency within the bounds of a short-term profit taking. The previous week was the last full week of the year. This week the market liquidity will be limited before the holidays and right after them in the expectation of New Year's Day. The end of the last week, when the single currency grew from 1.3620 to 1.3700, spoke about the bulls' strength. Technically, the market has broken the uptrend, which is passing through the lows of November 7 and 21 and also of December 4, yet the reversal hasn't been confirmed. Apparently, selling will get more intense only when the support of 1.3600 is broken. Probably, it won't happen before the end of the year as the situation in the markets is less tense than a year ago, when everyone looked forward to the agreement on the US federal budget. Now the only risk factor is Europe. And even here the risk can come from some unexpected news, no planned tense moments and releases are in view. It creates a favourable environment for further purchasing of the single currency. It is quite possible that today or tomorrow we will again see 1.3700 and further attempts to consolidate higher before the end of the year. Though the pair's short-term prospects seem to be positive in our opinion, there might be some serious difficulties with breaking through 1.3800. The only noteworthy news by the beginning of the EU session is raising of the US GDP forecasts by the IMF. Traditionally the Fund publishes the revised estimates in January, but already this weekend Lagarde mentioned that the growth forecast for 2014 will be revised up from 2.6%. Before the crisis it aroused more active purchases of risk assets and eventually selling of the dollar. Now the situation can be somewhat different as the States, unlike many others, will cut the bond-purchasing programme, which will hardly give rise to an upsurge of the global inflation.

GBP/USD

The pound feels a bit better than the single European currency, mostly because of the stronger performance of fundamental indicators. Last week's strong employment statistics pushed the sterling forward. Before that it had sunk from 1.6460 to 1.6215. And the combination of the initial reaction to the Fed and of the resumed growth on the release of the employment statistics let the pair hit a fresh yearly high. Now it is more likely that the pound once again will struggle for 1.6400 already before the end of the year.

USD/JPY

Despite the positive performance of the Asian exchanges, traders prefer not to take risks with the yen. At the end of the last week the pair hit a new five-year high of 104.63, but now it dipped below 104 on the retreat of USD. There is a threat that the pullback will be deeper, to 103-103.30, which will again make purchasing of the pair attractive before growth resumes.

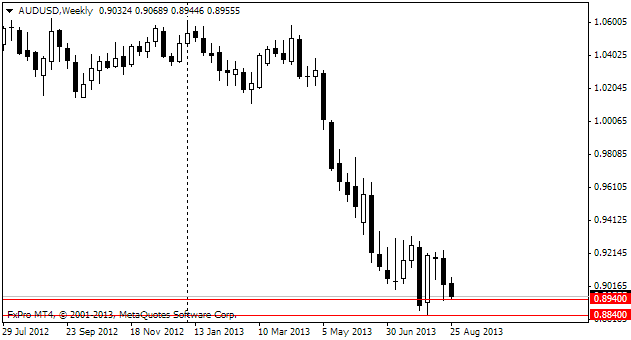

AUD/USD

The aussie hit a fresh low and calmed down. Last week audusd fell to 0.8819, then retreated and is now trading at 0.8930. It is not a big progress as the pair remains close to the lowest levels for more than three years, but it may mark the beginning of the large-scale profit-squeeze after 9 weeks of the Aussie's total depreciation.