EUR/usd

The Fed's commentary provoked strengthening of the US dollar. Purchasing was caused mostly by the increased intention to raise the rate next year. It is not stated in the published forecasts, but observers have figured out that these forecasts speak about a possibility of the rate increase approximately in the middle of the next year. If actual and forecasted data differ significantly, the QE3 programme may be brought to a close already this year. Yesterday's cut, as expected, made 10bln dollars. Besides, fomc chose not to peg interest rates to the unemployment rate, but consider a wider range of indicators. Apparently it was also caused by structured changes in the US labour market, where unemployment is decreasing due to the reduction of the participation rate. eurusd reacted with the decrease by almost a percent, from 1.3915 to 1.3810. We still believe that it can be the beginning of a continuous downtrend in the pair, which will exhaust itself only at 1.30. Europe feels quite good as compared to the last-year performance, but suffers low inflation and below-the-potential growth, which won't allow for the policy tightening in the foreseeable future. Besides, the Ukrainian crisis, if the economic sentiment indexes are true, affects the regional economy. It is in Europe's interests to back up the Ukraine for the short haul and try not to aggravate the situation in the region. This afternoon the EU holds an unscheduled summit to solve the issues concerning Russia and the Ukraine. Now, after the referendum was held and Russia explained its position, it is logical to expect the Western response.

GBP/USD

The sterling tumbled down just like the euro did during selling of risky assets. The pound/dollar got close to 1.6500, while in course of the day it had hit 1.6650. As we see, the pound is coming under stronger pressure. In the 4hr and daily charts the signs of a downtrend are getting clearer. Yesterday's Budget Release, despite indicating an upward revision of the growth rates, pointed out higher load on well-to-do citizens, which is not welcomed by the markets. The latter prefer when the policy is targeted at stimulation of short-term spending.

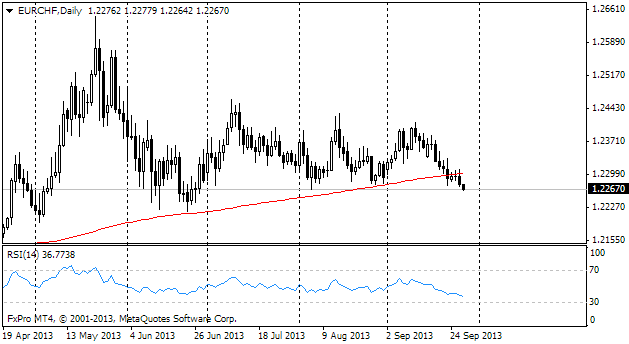

EUR/CHF

The euro/franc is moving up, getting back to the levels of the beginning of the previous week. Yesterday once again we saw how growth was accompanied by pressure on the single currency. The current weakness of the euro/dollar is caused by this, so the single currency is purchased against other instruments like the pound and franc. Today Switzerland announces the quarterly monetary policy assessment. There aren't any changes expected, but it's better to be careful.

NZD/USD

The New Zealand dollar got a blow on FOMC's decision yesterday, but then bears made use of the GDP stats, which proved to be weaker than expected. The New Zealand economy grew by 0.9% in the fourth quarter (against the expected 1.0%), while the annual rate coincided with the forecasted 3.1%. These are fairly good rates, though we believe that the economy has already passed its maximum impulse. This way or another, the technical indicators have given a clear selling signal for the coming few days.