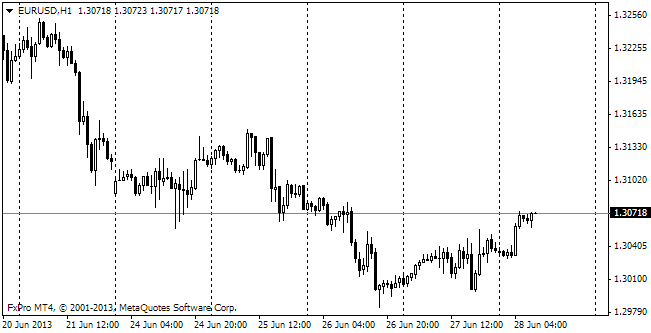

EUR/usd

Draghi, who yesterday celebrated the second anniversary of his tenure as president of the ECB, acted in a very unexpected way. The ECB lowered the refinancing rate by 25 basis points to 0.25%. The deposit facility rate was kept unchanged at the zero point. The interest rate was also cut by 25b.p. to 0.75%. At best the governing council was expected to have given some hints at taking action in a month or to have announced liquidity support through other tools of the ECB. Draghi again proved to be more maneuvering than considered by many. At the press-conference he pointed out that there had been all evidence that this measure had been necessary and that there hadn't been any sense in waiting for another month as inflationary tendencies did not promise any problems there. Generally speaking, the effectiveness of the rate cut may seem doubtful. After it had been cut by 25 points, the interest rates for the real sector decreased just by 7-9 points. Anyway, this cut should affect loan costs for the banking sector. This is right the measure that we expect next month. Another round of cheap loans for the EU banks will be this very incentive that will help to keep the situation stable, preventing further deterioration. Initially the single currency tumbled down all across the market. eurusd fell by over two figures, from above 1.3500 to slightly below 1.33. Apparently, the fact, that the actual effect of the rate cuts is not very strong, let the pair recoup some of the losses later. Now the pair has stabilized approximately in between yesterday's high and low, at 1.34. Now the market is still waiting for the US employment statistics. Yet, after the activity we saw yesterday we can hardly expect high volatility from today's payrolls. Technically, yesterday the market gathered lots of stops and even closed the gap at 1.33, which had formed earlier, on September 16.

GBP/USD

The fuss around the single currency for a while tackled the British pound. The BOE failed to surprise the markets, keeping the policy unchanged and giving no comment to its decision. The pound reacted to the rate cut in the eurozone by decline, which however didn't last for long. In a few hours gbpusd returned to the previous levels. Leaving yesterday's ‘fright', we can say that for three days in a row the pair has been at 1.61, hoping to get further signals to start moving in one or the other direction.

USD/JPY

The moves in the yen were much more impressive in comparison with the British currency. The initial reaction to the policy easing in Europe was growth of stock markets, which boosted purchasing in usdjpy. It rose to 99.40 (+0.7%). But further stock exchanges stumbled over the selling, which carried away the yen. The pair tumbled down by 1.8% over 5hours and managed to stop only at 97.60. The yen suffered for no particular reason and the most discouraging thing for bulls is that this all can be far from the end as there are the US employment statistics ahead and the pair is not oversold now.

AUD/USD

We can observe an interesting picture in the aussie. The hourly charts show that the currency is first intensively sold and then gradually purchased. Now we see more factors contributing to the decline, so we remain in the downtrend. Anyway, we can't exclude that those who ‘pick up' the Australian currency now in the slack period eventually will turn into fierce bulls in the coming days.