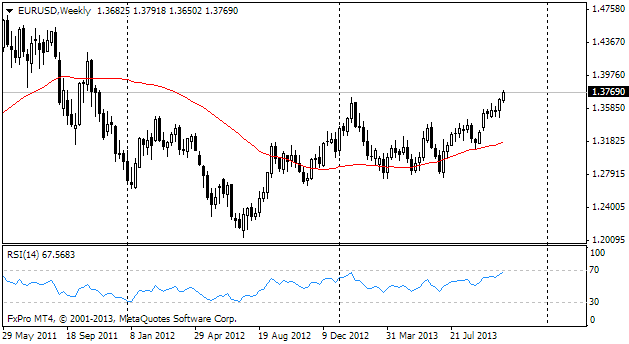

EUR/usd

The euro doesn't even think to retreat. Yesterday's correction in the pair from 1.3790 to 1.3740 by the beginning of the US session had ended with another uprise to the upper bound of the new channel. And in the Asian session today after a short respite the pair is again testing the resistance of the channel. Among yesterday's statistics only the Consumer Confidence Index for the eurozone is of interest – it showed some improvement. However, it is hardly possible that growth of the index from -14.9 to -14.5 is the reason for the positive sentiment in regard to the single currency. Besides, stock markets are very cautious now. Traders are throwing worried looks at China, where banks are writing off bad debts and the government doesn't hurry to restore liquidity to the adequate levels, thinking that it helps to form bubbles. However, cautiousness of stock markets and demand for the safe yen and franc didn't affect attempts of euro-bulls to hit new highs. From the technical viewpoint the present moment looks interesting. If we draw the resistance line through the highest closing levels of the pair in 2008 (1.5937) and 2011 (1.4807), we'll get that now it should pass through 1.3816, which is not far off. Of course, advocates of technical analysis can always find a dozen of other important levels. If the mentioned line is of some importance, first of all, it will lure bulls and, if broken, it will boost further growth of the pair. This scenario is possible (we cannot disregard anything in Forex), but anyway, in our opinion, it is more likely that purchasing of the dollar will become more intense in the near future as investors will be realizing that Europe is still very weak. This idea may be proved today on the release of Preliminary PMIs for Germany, France and the whole eurozone.

GBP/USD

The British pound is unable to keep up with the single currency, though its current strength is enough for growth against the US dollar. gbpusd before the beginning of the EU session today had returned above 1.6200. The minutes of the MPC's meeting in October showed that the markets had been supposing for long that the rates would be raised before 2016. Since the markets had realized it earlier than the Committee, it didn't arouse any strong reaction in the sterling.

USD/CAD

The Loonie fell victim to the US monetary policy. The commentary of the BOC, published after another meeting of the bank, made it clear that consequences of the government shutdown are likely to lead to economic slowdown not only in the USA, but also in Canada. In this connection the BOC put aside the comment regarding the rate increase from the current 1% in the near future. The Loonie proved to be one of the weakest currencies against the dollar yesterday. usdcad grew from 1.0280 to 1.0395 during the day. Apparently, it is only the beginning and we will see lots of such revisions by the CBs in the coming weeks.

AUD/USD

The aussie, which was harshly and to some extent even unfairly sold out, keeps getting support on weakness of the US currency. The troubles of the Australian dollar were caused by the retracement after the heavy growth from 0.9280 to 0.9750. Yesterday we saw a mini-pullback to 0.9600, but already today the currency again has returned to 0.9660.