On Friday common currency was under pressure increasing its downtrend that was formed at the end of Thursday trading. Important is the fact that such decline was not caused only by usd growth, as well we could monitor gbpusd growth. The pressure in UERUSD pair cannot be explained either by positive mood of stock markets since most world markets, except of Japanese market positive tendency, were in a red zone. By the end of the trading day the pair declined to lowest level since the end of March 1.1210, having renewed April lows to 1.1233. Today bulls are trying to form the rebound to the levels 1.1256. Pair's fluctuations in April have formed quite wide downtrend, lower boundary of which was reached today at the beginning of the trades, while the upper boundary is currently going through 1.1387 level and will drop to 1.1350 by the end of the month. Of course, there is a big possibility that rebound to the upper boundary will happen before the end of the month since this week Fed Reserve meeting is taking place. This meeting is going to be intermediate and will not be followed by press conference and forecast releases of fomc members. However, the comment going along with the decision may be used by officials as a tool to manage market expectations. At the moment, markets do not believe in the coming rate increase, though analysts of investment banks speak about such possibility in June. In case Fed Reserve is really planning to raise rate in June they should make a transparent sign in order not to make such rate increase unexpected. So far FOMC is proud that December rate increase was one of the most expected in history. In a short-tem, market participants today should pay attention to New Home Sales release. Earlier, last week, releases of Home construction brought disappointment, meanwhile Home sales were quite good. Therefore, this sector data is balancing between slowdown and correction on the relatively healthy levels.

GBPUSD

The pair has opened the week with the higher gap that is now closed. However, pair's increase led it to the highs of the month. One of the reason they name is Obama's appeal to the UK to stay in EU. As per technical analysis the pair is close to overbought area staying at the upper line of Boolinger Bands on the daily charts and going lower from 70 area hour RSI, meaning losing its impulse after good growth and starting bearish divergence on the same indicator.

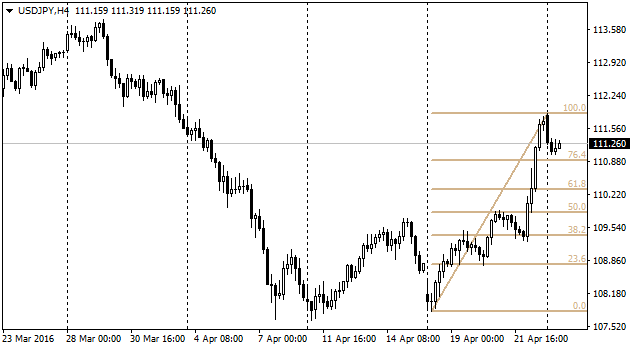

The pair was going higher during Friday and reached 111.90. Although, the beginning of the week was not supporting USDJPY bulls. The denial of Friday news about possible start of lending on negative rate by the bank of japan effected market participants to fix their profits when trading started. However, the pair did not go too low getting support at levels above 111.0. There is no smoke without fire – that what traders think and it interrupts further decline in the pair. This week the main news on JPY we are going to have on Thursday. Several hours before that Fed Reserve will release its monetary policy comment, and at the beginning of the day we will have inflation release and rate decision.

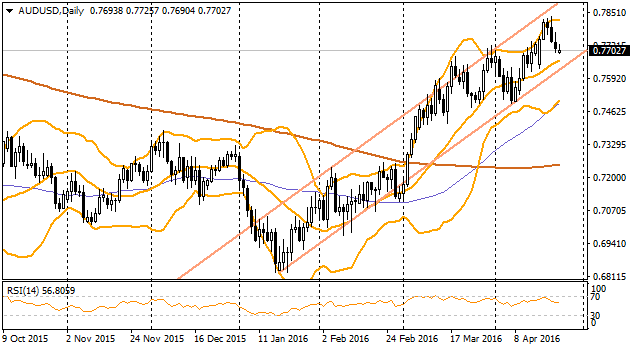

Australian dollar has returned to 0.77, rebounding from level around 0.7839 that is not far from highs of last May. Current decline is nothing more than Fibonacci correction of growth from the first week of April (61.8% of rally). However, drop below that will identify deeper decline in the pair.