EUR/usd

Strengthening of right-wingers in the European Parliament has complicated the position of those, who insist on austerity measures. It was quite expected that the number of euroskeptics would grow, but the actual growth has proved to surpass the forecasts and, as a result, put the single currency under pressure on opening of the trading day. Trading is now close to 1.3620, whereas the lowest level reached by the pair was 1.3612. Technically there is some reason for this poor beginning of the day. The single currency closed the week below the important 200-day MA, which promises growth in selling as large investors will want to close their sell orders in anticipation of a deeper drop. Though it actually doesn't mean that the increase in the number of euroskeptics is sure to lead to disintegration in Europe, it still will definitely slow down the integration process. Very often the markets take the integration processes favourably as they are often good for business in general . So, the forming disposition may give more causes for concern and the integration process, which is already ridiculously slow, may slow down even more or even stall since it has opponents not only in France, but also in Britain and some southern countries, which more than others suffered from the sovereign debt crisis. It's surprising that the rebound, so much expected on Friday, didn't occur. Today the USA and UK are having a holiday, so most players are not in the market, which may leave the rates within very narrow ranges today.

GBP/USD

The cable also started the week with a drop, but quickly overcame the initial negative as players are more and more busy with the approach of the first rate increase. Anyway, now the pair is lower than it was at the similar time on Friday. The dollar demand got stronger at the end of the previous trading week, thus sending GBP/USD down to the low of 1.6812. Unlike the euro, the pound is only under the pressure of its own weight, since the pair has climbed quite high already. The pound still looks good against the euro, but its prospects against the dollar are rather doubtful.

USD/JPY

The 200-day MA in USD/JPY once again served as a support for the pair. The latter managed to come to the surface after a very quick dive below 101.00. The pair's coming off the extremums may stir up those who are looking to the further depreciation of the yen, but didn't venture it while on the high. We still believe that the cycle of the pair's growth is being far from its end.

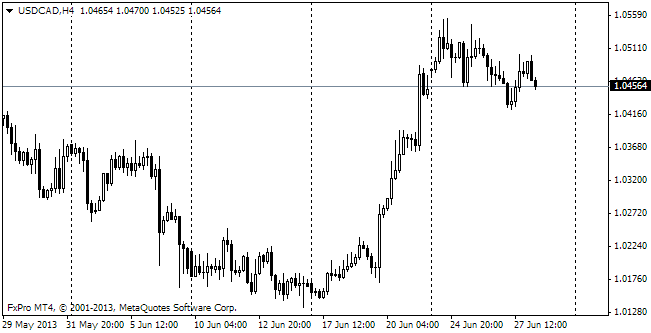

USD/CAD

The pair completely stopped following the general upward/downward trend of USD. Friday's growth of the dollar against the yen and the EU currencies came along with weakening of usdcad, i.e. with purchasing of the Canadian currency. Yet, the supposition that the pair behaves as if it was counter-cyclical can't be considered totally true. On Friday the markets were actively growing.