EUR/usd

The euro climbed quite high yesterday, after Draghi's words that the monetary policy doesn't need any adjustment now. The ECB is still confident in the positive effect of the November rate cut, but adds that it is not very visible yet. We've frequently mentioned that the currency markets suffered a period of even higher rates of the euro short-term loan before the New Year Day. The impact of the decline by quarter of a percent can be noted only with other conditions being equal, which never happens in the market. And the unwillingness to take advantage of inflation slowdown to ease the monetary policy looks really puzzling. There is a feeling that Draghi turns into Trichet, reporting about successes of the ECB and referring only to closeness of inflation to the target levels. He'd better pay attention to the EU growth rate, lagging behind the USA and Britain, where the CB didn't attach itself to inflation too much when shaping the monetary policy. In the final analysis we have that next month the ECB will only come up to considering changes in the policy, which will coincide with the quarterly revision of the Bank's forecasts. While Draghi was focusing on general comments, the euro was sliding down on the release of a bit stronger data on unemployment claims. But it made the further upsurge of the rates only more dramatic. From the daily low of 1.3482 the pair grew to 1.3618, after which it went on drifting at 1.3590 in anticipation of the US statistics. It is expected that the labour market grew by 185K in January with unemployment remaining at 6.7%. Technically, the single currency is slightly above the middle of the downtrend. There are still 60 pips to the resistance and 120 ones – to the support. Despite the beginning of selling in the pair, it would be more reasonable to play pending orders beyond yesterday's extremums.

GBP/USD

The British pound seems to have regained its old high correlation with stock exchanges. The bounce at them led to a pullback by a figure to 1.6350. There are some contradictory news for Britain. On the one hand, the industrial production went far below the expectations, growing only by 0.4% instead of 0.7%. On the other hand, there is a decrease in the trade deficit by over 2bln as compared with the previous month. The trade balance has shrunk to the deficit of 7.7bln against the expected 9.3bln and the November 9.8bln. Of course, much due to the expensive pound.

AUD/USD

The RBA in its quarterly report on the monetary policy optimistically speaks about the effect of the national currency depreciation, promising that it will boost the GDP growth. Yet, we should understand that it will also increase inflation pressure. The main thing which struck the eye in such reports was alertness in regard to the economy's shift from the investment boom rails to the domestic demand. Now the RBA has focused on inflation and the GDP rates. The neutral tone of the monetary policy may help with consolidation of the currency, which has significantly declined over the preceding three quarters. The next step will be to raise the rate rather than to cut it, but it will hardly happen this year.

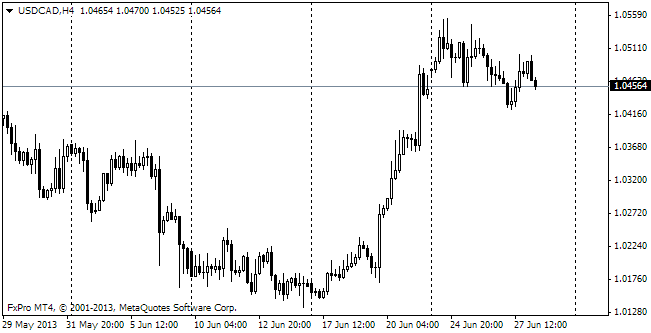

USD/CAD

The canadian dollar feels much more confident this week. Behind are sharp drops to the lowest rates for four years and a half. Behind is also an impressive profit-squeeze, which served to a pullback by over two figures. This week trading is held generally between 1.1060 and 1.1110. And today it is a big day for the pair as together with the US statistics there will be a release of domestic data. It will predetermine the fate of this week's consolidation in usdcad: either further growth to new highs or decline, where supports are seen at 1.1030 and 1.0950.