DXY

The euro remains in the uptrend, forming a chain of ascending highs. It is a good sign. It is also good that eurusd feels more and more confident above 1.32. Yesterday the intraday high was set at 1.3238. Actually, we can't say that the current growth of the pair is as speedy as the preceding decline. That drop was caused by the market expectations of QE-3 reduction in the near future. Meanwhile, the current growth results from the revision of these expectations. The same hypothesis is proved by the US debt market. There last month's upsurge of yields has been almost fully recouped. One-year bond yield is again at the historic lows, and two-year bonds have declined to 0.34% from 0.43%. Thus, the market participants have lowered their expectations, though all this fuss over the QE reduction has caused lots of troubles in the developing countries, but about this later. Generally speaking, Americans don't care what is going on outside the States, if it has no effect on them. But here we should mention that already now the current policy of the Fed risks blowing up a bubble in the housing market. Monday's statistics on the existing home sales reflected a decrease in June, but few commentators paid attention to the median price of homes. It grew to 214K and this is a 13.5% increase over a year. Four years ago an average new-build was cheaper. According to the recent data it already costs 263K, and the freshest statistics – for June – will come in today's report. We still believe that it will be reasonable for the Fed to moderate their support of the housing market, while it is too early to stop bond buying as the US budget deficit is still quite considerable.

GBP/usd

The dollar's retracement also makes way for the sterling. gbpusd keeps moving up and yesterday it was the sixth day closing positive. Actually, it is not very typical of the pair to have such continuous rallies, but it seems that the situation has changed over the recent years and, as a result, no longer arouses astonishment in traders. Anyway, there is a growing feeling that the cable will need a correction, even though during the short-term profit-squeeze.

USD/INR

In the meantime, the capital outflow in India is growing. This week the government has taken quite an ambiguous step, raising a part of their interest rates to 2 percents and keeping the main rate unchanged. This step is meant to curb the capital outflow from the country and darn the hole in the current account balance, making investments in the domestic currency more attractive. On the other hand, it will be more difficult for India not to wander from the path of growth, as already now it is on the brink between decline and growth. Anyway, the record lows of the rupiah against the dollar and decline by 15% over three months surely require interference.

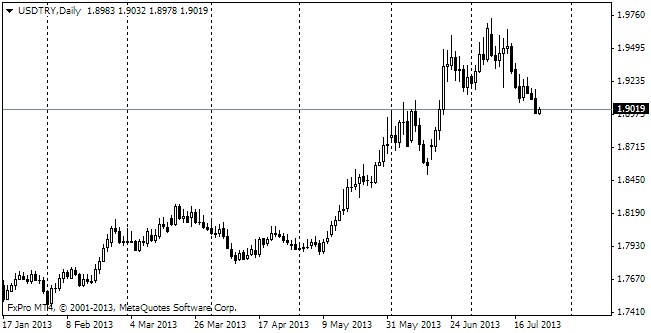

USD/TRY

The similar step (raising of the secondary rates) has been taken by the Turkish CB this week. The country is in pretty much the same situation: it is vital to stop the capital outflow and slow down the decline of the domestic currency. It partially was done due to the change in the Fed's rhetoric, but over the preceding two months the lira lost 10%. Note that these significant shifts have taken place without any actual actions, only on the discussion of such a possibility.