EUR/usd

Yesterday's data on the US GDP proved to be a real disaster and caused weakening of the US currency. Often the final (third) estimate of the US GDP doesn't bring any significant changes, but this time the annualized growth rates were considerably revised down to -2.9%. Yet, the expected decline made only 1.8%. A month ago it was reported about the decrease by 1.0% and initially – about growth by 0.1%. Thus, with time the GDP estimate for the first quarter has deteriorated. Many experts, including the Fed's members, think that it is an extremely retrospective view as it considers a very remote period and besides it's been affected by the weather. We support this viewpoint. The labour market, which is also a leading economic indicator, has felt quite good since the beginning of the year, actively creating new jobs, decreasing the unemployment rate and maintaining the pace of wage increases. All this promises higher spending in the following months. Some investment banks have already raised their estimate of the GDP growth in the second quarter, expecting a pullback after a deep drop in the first one. In the meantime, the poor growth of consumer activity also arouses questions. In March the retail sales grew by 1.5% and in April and May together only by 0.8%. The Durable Goods Orders, a confidence indicator for corporations and helper to estimate future expenditures, tumbled, according to yesterday's data, by 1.0%, offsetting the gains of the previous month. Against this background the favourable Services PMI by Markit ( they also estimate the EU indices) got somewhat lost. Here we saw the sharpest growth over the short history of observations (since October 2009). The index grew to 61.2 in June against 58.1 in May. The press-release reports marked improvements in new business inflows. The latter is perfect groundwork for the future, but doesn't let the dollar grow yet. With such a background it is quite an expected thing that the euro/dollar remains above 1.36. It won't be a surprise if today there will be another attempt to break through 1.3650.

GBP/USD

USD's weakness stopped selling in the sterling. The cable continues its fight for 1.70, still being below this level. Carney's comments, regarding the poor rate of wage increases, provoked profit-taking a couple of days ago. However, the bond markets didn't see any significant change in the interest rates. It signals that behind profit-taking there is no real change in the expectations. Lots of market participants suppose that the policy may get tougher already this year. Earlier we couldn't believe that the BOE would raise the rate before the Fed, but the latter proved to be very cautious. Probably, for a reason.

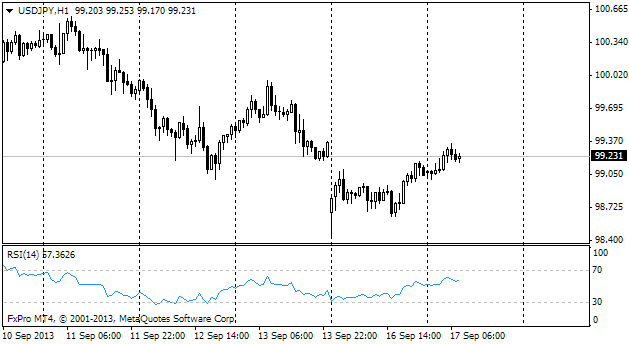

USD/JPY

The consolidation range was broken down yesterday, which looked quite unexpectedly as the markets resumed their growth. The main factor was weakness of the US currency. Meanwhile, very soon technical factors will be able to step into the game. usdjpy has closely approached its 200-day MA (101.63 now). It is more likely that the dollar will get support at these levels. However, we shouldn't completely disregard the pressure of bears, trying to ruin the technical picture of growth.

USD/CAD

The Canadian dollar keeps appreciating against the American one. There is just half a figure to the target level of 1.0650. The pair remains overbought, but doesn't want to enter the neutral zone. It means that it is more reasonable to start purchases later.