EUR/usd

Yesterday we reported that Monday's business activity statistics proved to be worse than expected and indicated growth slowdown. Yesterday's Ifo indicators also fell short of expectations. The Business Climate index has been falling for two months in a row, though even now it is still quite high. What was the euro/dollar's reaction? None. The single currency continued its attack on the US dollar, going to 1.3627 in the heat of the EU session. Then the pair was affected by caution of the market players, who didn't hurry to take their profits after hitting a fresh historic high in the US indices. Anyway, almost right after going below 1.35, purchases became more intense as market participants finally separated the situation in the stock markets from the currency market. Now eurusd is now taking another attempt to hit new local highs. If it manages to do this despite disappointing statistics in the region, while there is no important news the attack of 1.3630 and further trip to 1.3670/75 even have a better chance of success. The 200-day MA never yields that easily.

GBP/USD

Yesterday the cable was depreciating against most of its rivals after Carney's words that salaries were not growing as quickly as expected by the CB. These words revealed the cause to which the regulator can cling to justify the slower pace of rate increases or to start the cycle of toughening later. The cable has tumbled from 1.7030, which preceded Carney's speech, down to 1.6970 now. Today there won't be any important statistics for Britain , so apart from the constant, but subsiding pressure on the sterling, we will have to deal at worst only with traders' reaction to the US statistics. We expect a release of data on Durable Goods Orders, which a month ago demonstrated impressive growth.

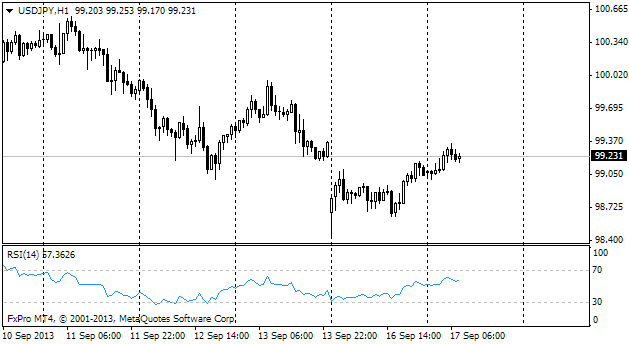

USD/JPY

The range in which yen is stuck is getting narrower and narrower. Yesterday's attempts to grow were stopped almost immediately after breaking through 102.0. This morning the pair was trading at 101.85, but here again it finds support. At such moments caution is much needed, as should the pair break out of the range, volatility may increase sharply. Now such bounds are seen at 101.80 and 102.20. It's just 40 pips, but already for more than a week the pair has felt unsteady beyond these bounds.

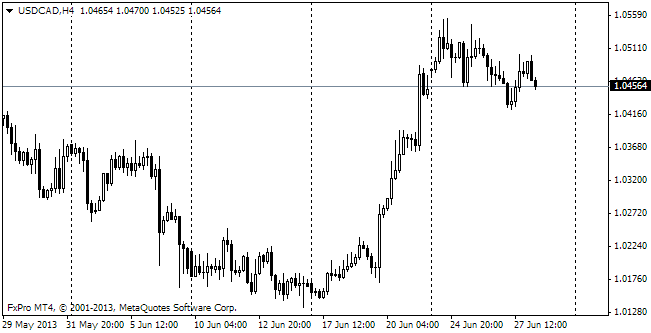

USD/CAD

The Loonie is consolidating, finding ground at 1.07. This consolidation can turn into a full-fledged pullback. If it happens, bulls may have a chance to go above its 200-day MA. Should the pullback develop, the first target can be 1.0830, which used to be a support and now is quite able to become a resistance. However, for that USD should take the offensive across the board.