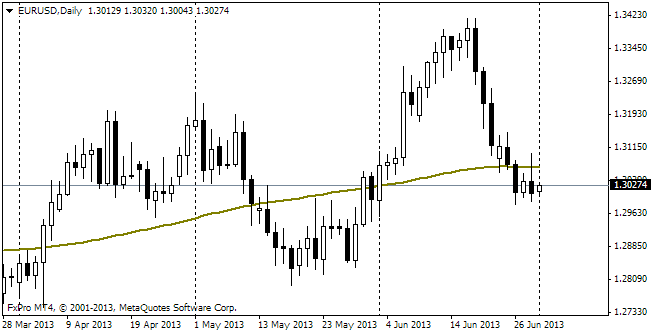

EUR/usd

As has already been written, breaking through 1.3500 can be regarded as confirmation of the downtrend in eurusd. It is quite remarkable that the pair, ignoring the fundamental indicators lately, has finally found one important indicator, which managed to shift the balance of forces. We mean inflation statistics. How come that this generally well-predicted indicator, which has brought no surprises so far and hasn't affected the monetary policy since the beginning of the crisis, now produces such a great impact on the pair? The thing is that the peripheral countries of the eurozone suffer deflation, besides the current monetary policy remains too tough to boost lending and demand. The recent Spanish statistics reflect well the latest trends: mortgages have shrunk by 27% y/y, a year before they declined by 34.4% y/y and earlier – by 33.1%. Eventually the mortgage market has reduced to 10-15% of what it was like before the crisis. Of course, we can say that then the market was at unsteadily high levels, which it shouldn't reach in the foreseeable future. But even the current 13K of mortgages is just a wan shadow of those 80K at the beginning of 2000. And what's more important this indicator keeps decreasing, which means that lending terms in the country are not mild enough. This is an example with Spain, the largest of the suffering countries of the eurozone. We simply don't have any comparable indicators from Greece and Portugal. However, the consumer activity stats published there draw the same grim picture. The slowdown there is not finished, perhaps its pace has decreased, but that's all. Under such conditions the ECB should use any opportunity to reduce the inflation pace in the eurozone in general and in Germany in particular in order to ease the monetary policy and also stimulate lending in the banking sector. Against this background Friday's data on inflation slowdown to 0.7% in January against the expected 0.9% immediately made large investment banks forecast the ECB's rate cut in the current month.

GBP/USD

Though the inflation slowdown in the eurozone will hardly extend to Britain that quickly, the sterling suffered pressure on Friday. As has already been mentioned, the pound-bulls should be very careful as the pair has felt very unsteady above 1.65 in the recent years. Now some of the published data still remain relatively optimistic, but others already reflect a sharp decrease in the rates. In addition, the BOE obviously doesn't want to hurry to toughen the policy, which will be seen in the results of the MPC meeting or, what's more likely, after the Inflation Report release. Today all attention will be riveted on Manufacturing PMI for January, which may confirm decrease in the growth rate.

USD/JPY

The Japanese yen remains under pressure due to the correction of stock exchanges. The Nikkei index, which shot up by 57% last year, has lost 10% since the beginning of this year. Formally, it marks the beginning of a correction and doesn't let usdjpy come off 102.00. In our opinion, the Japanese corporations show good profit performance and it means that soon the yen will be in demand. The CB should keep an eye on it and probably will increase incentives to prevent the yen's appreciation in the period of profit repatriation (quarter one).

AUD/USD

The Australian statistics aren't good yet: the number of building approvals has been decreasing for three months in a row. Formally, the yearly growth rate remains high (21.8%), but since September the number of approvals has shrunk by 5%. The number of job advertisements is also decreasing. Now their amount in the media and internet is by 8.9% less than a year ago. These data are scarcely enough for the rate cut tomorrow, but at the same time it is still too early to expect change of the dovish sentiment into the neutral one.