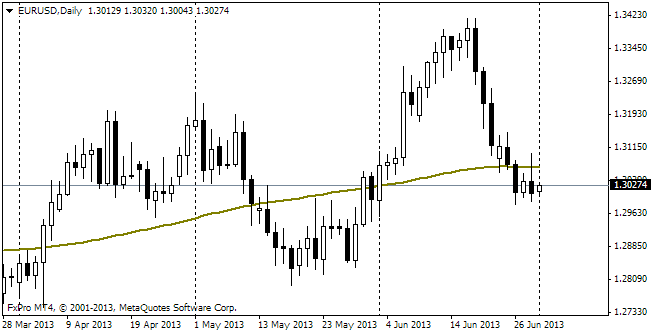

EUR/usd

Forex trading on Thursday was very nervous. The difference between the intraday top and bottom made 130 pips. It's noteworthy that the rally towards 1.3300 was supported by quite positive statistics from Europe, but the main movement took place in the US session and was spurred by shifts in the US debt market. The latter is heading for higher yield. The minimal 10-year treasury yield of 1.39% about a year ago is now quite far from the current rates, showing the yield of 2.57%. Don't be surprised if soon last month's high of 2.76% is broken through and a fresh high is set. America is gradually abandoning the ultra-soft monetary policy, so the interest rates are getting back to their normal levels, that is above 3% in 10yr bonds. This shift is to the benefit of the EU currency, yet the statistics coming from the Old World also look very reassuring. Earlier this week we got strong PMI data for July and yesterday there were favourable Ifo statistics. The Business Climate Indicator proved to be a bit worse than expected ( they were affected by the strong PMI), however 106.2 is quite a high level, which has been last seen only in March. Remember that the cyclic highs of the indicator often happen near 110. The shifts in the US debt markets coupled with signs of improvement in Europe have helped the single currency rise close to 1.3300, which haven't been observed for a month already. For less than three weeks the pair has gone up by 5 figures and a half from 1.2750. Not bad, yet there is a ‘but'. Before these three weeks the decline was even swifter. It seems that the only force that can stop the dollar from the further decline is the fomc headed by Bernanke, who can demonstrate a more hawkish tone in their commentary after the meeting on July 31.

GBP/USD

The sterling is trying to keep up with its neighbour. Last night gbpusd rose as high as 1.5389, which is also a monthly high. Investors were not impressed by yesterday's Preliminary GDP, which showed that in the second quarter the economy grew by 0.6%. Probably, it was because of the considerable revision of the preceding statistics, which made the decline during the global financial crisis deeper. But leave the prejudices aside. The annual rate of the economic growth in Britain already reached 1.4%, which hasn't been seen for 2 years. Besides, the positive dynamics are observed in all major groups: production, services, construction and agriculture.

USD/JPY

Japan has finally seen inflation. The weakness of the yen at the end of the previous year and in the first quarter of this one eventually has brought the consumer price index to the positive area. Moreover, the index managed to go beyond expectations. The annual inflation in the Land of the Rising Sun made 0.2% and with food prices excluded it totaled 0.4%. Anyway, weakness of the dollar proved to be more important for the markets as USDJPY is moving down, now being already below 99 yens per dollar.

AUD/USD

The aussie also looks not so bad already. Of course, it is all due to weakness of the US dollar. Anyway, audusd hasn't managed to go out of the 0.9000-0.9300 corridor, where with a certain proviso it has been trading already for five weeks in a row. We shouldn't expect that the resistance will be broken before the FOMC's meeting next Wednesday, to say nothing about today.