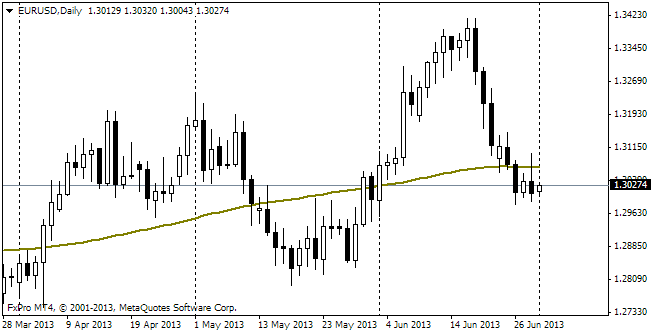

EUR/usd

Despite the strong domestic statistics, the American currency still feels pressured. Nevertheless, the pressure weighs not only upon the US currency, but also on other safe assets. The yen and franc are suffering and the stock markets keep demonstrating impressive growth. This surge of optimism has been caused by the news that the US employment market is doing well. The weekly unemployment claims have reduced by 42K to 338K instead of growing to 380. The forecasters have made a serious mistake, or probably it is all about the holiday season, when population gets less active. After all, the number of continuing claims has increased and it means that the swiftly decreasing staff turnover is not the point. We again return to the correlations which were observed before the financial crisis, when the good news from the USA spurred demand for risky assets, and more risky ones felt much better. At that time the movements of capital and markets were based on the realization that the Fed stuck to the extremely soft monetary policy, and other countries not only had a bigger potential for growth, but also strictly observed the monetary rules, maintaining a higher level of interest rates, which favourably told on investment profitability in the money markets. If the markets keep doing as they did before the crisis, nothing has actually changed. Probably, this is so, but it is hardly possible that the Chinese growth, which became twice as little, and the teetering eurozone will be able to oppose the recovered USA. At least, the rest will need time to catch up with it.

GBP/USD

The sterling is also crawling up. The favourable domestic statistics let the British currency be in constant demand. gbpusd managed to return to the yearly highs and is now trading at 1.6440. The bulls successfully dragged the pair out of the channel, after which the ascent went smoothly and easily. The preceding highs of 1.6460 and 1.6480 are important resistances now. Should the pair get beyond these levels, it will become prone to triggering stop orders, which will make its further growth absolutely unpredictable. But even in this case it is quite possible that there will be a wild drop next week.

USD/JPY

The Japanese yen met the target of reaching round rates. Last night usdjpy hit 105, which came as a result of the optimistic (for the yen sellers) inflation, retail sales and employment statistics. The core inflation surpassed the forecasts in November and grew to 1.2% in the index, excluding fresh food, and 0.6% y/y with fresh food and energy excluded. A month earlier these indexes made 0.9% and 0.6% respectively. The retail sales in November grew by 1.9% against the preceding month and against the same month a year ago – by 4.0%. In November 2012 the growth made just 0.9%. Abe's government will hardly disregard this merit.

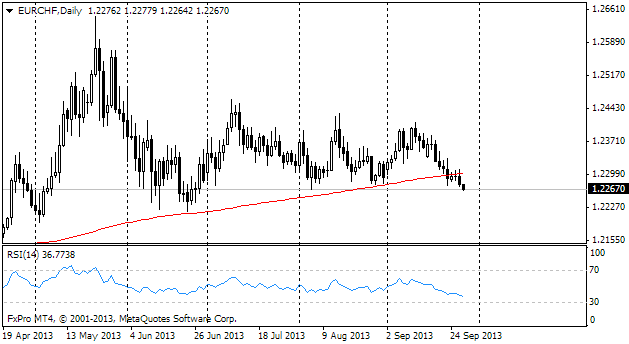

EUR/CHF

As expected, the franc is getting back to the neutral levels against the euro. The extremely oversold condition of the pair since the beginning of December gives way to the habitual rates near 1.23. This return is going on faster than expected. However, on the whole we treat the euro as a weak currency, which won't be able to stay in favour of the markets for long, thus impeding the further ascent of the currency. Quite likely, the euro/franc will become less attractive at 1.23 for those who love trends.