EUR/usd

The euro-bulls still hope to offset at least a part of the dollar's appreciation. On Friday they managed to take the pair up to 1.2980. But at these levels the pair found enough buyers, which threw it off closer to the middle of the traded range. The short-term support, which appeared last week, still works, showing signs of a feeble uptrend. Probably, it will become stronger if the EU statistics are favourable and the US ones are poor. The EU trade balance can be one of such news. It has been steadily high in the recent months due to the economic rebalancing in the EU south. The Russian sanctions regarding foodstuffs were introduced at the beginning of August and won't affect the rates published today. The USA releases data on its industrial production. It is expected that it will grow by 0.4% as a month ago. These data especially attract attention before the Fed's meeting. If they fall short of the expectations, we shouldn't expect that the fomc will change their rhetoric and demonstrate a more hawkish mood during the press-conference. Don't forget that the employment data in August were rather disappointing.

GBP/USD

The concerns regarding Scotland's secession have subsided after a row of surveys, which showed that advocates of the unity with Great Britain hold the majority. Anyway, the difference is very small and the policy of intimidation of Prime Minister and Minister of Finance may stir the separatist mood of the proud Scots. The market situation is still tense as according to the unofficial surveys the difference between the camps looks nothing more than statistical uncertainty. The peripeties regarding the referendum of Scotland will be pushed on the sidelines for the pound probably only tomorrow, on the release of the consumer statistics and production inflation. The significant deviation from the expectations (+0.4% m/m and 1.5% y/y CPI) is able to budge the cable.

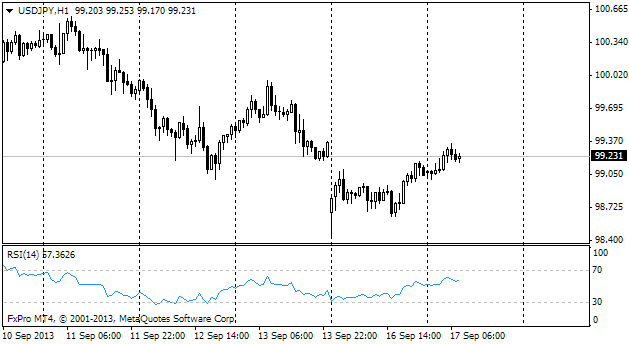

USD/JPY

The yen can take a break after the considerable weakening last week. The main reason for traders' cautiousness at the beginning of the week can be the coming meeting of the FOMC. Though it is not expected that there will be any deviation from the chosen course of tapering, traders will still carefully study the statement, searching for hints at readiness to increase the rate before the middle of the next year.

AUD/USD

The Australian dollar again fell under pressure this morning. This time its decline can't be attributed to the general uptrend in the US dollar as the latter didn't grow against most of its rivals at the weekend. The main reason for selling the aussie was poor data on the Chinese industrial production, published on Saturday. The annual growth rate has slowed down to 6.9%. The production growth rate was that low only during the crisis. Then the Chinese government announced a huge package of incentives, which took the economy back on the path of impressive growth, but blew bubbles in some economic sectors. But this time we shouldn't expect such generosity from the Chinese politicians, they will be more loyal to the economic slowdown, if we believe their comments at the beginning of the year. In its turn it means a possibility of further depreciation for the Aussie as China's production is a key growth driver for the Australian extractive industry and mostly ensures economic expansion. Due to this the AU currency, which has dipped below 0.90 today for the first time since March, can continue its way down, as desired by the RBA's head. Most likely, a fresh annual low will be hit in the coming few weeks.