Bitcoin has been trading sideways for the entire month now. The BTC/usd pair has made 2 unsuccessful attempts to break through the bearish level of $ 40,000 and 3 failed attempts to break through the bullish $ 30,000.

While bitcoin is stagnant, traders have switched their attention to altcoins. After the BTC rate began to correct from $ 42,000 area, the altcoin market came to life: billions of dollars are circulating on crypto exchanges every day.

If you are stuck with Bitcoin trades, it's time to take profits and look around: altcoins are becoming more and more attractive every day. Let's start our analysis with Ethereum, the second most popular cryptocurrency.

Will Ethereum rise to $ 3500?

Ethereum is currently demonstrating an interesting development:

The ETH price in bitcoin (yellow line) has slightly increased compared to the price in USD (green line).

The surge in dollar transactions suggests people are withdrawing dollars from other altcoins and classic assets and investing them in ETH. At the same time, investors do not sell their bitcoins yet, expecting the number one cryptocurrency to resume its growth.

Meanwhile, ETH trading volumes are growing. Over the past day, the altcoin added 20%.

It's worth noting that 86% of retail traders are betting on the uptrend in the short and medium-term.

ETH/USD technical analysis

Ethereum's uptrend is slowing down. Consolidation is observed on the main time frames:

And it's not surprising: Ether is moving towards its all-time high and a round level of $ 1500, which has been a strong barrier for the price since 2017.

The ETH/USD pair has approached the key psychological support $ 1000, below which buyers will be looking to the opportunity to earn.

Sellers, on the other hand, believe that the $ 1 500 area is worth selling and taking profits they had made thanks to January's rally.

Realistic scenario

If the cryptocurrency gains a foothold above the $ 1500 level, the price will have all chances to go further up to the $ 1900- $ 2200 area.

If Ether shows that it's not ready to rise any further, the bulls will pick up the cryptocurrency at the $ 1000 mark.

Optimistic scenario

Analysts and traders expect Ethereum to rise in the $ 3 500- $ 5 500 region by 2022. Whether these expectations are real depends on a number of factors:

● Use of Ethereum as a widespread means of payment

● Application of the Ethereum platform as a platform for developers (DEX, DeFi, applications with smart contracts).

● Bullish sentiment in the BTC market

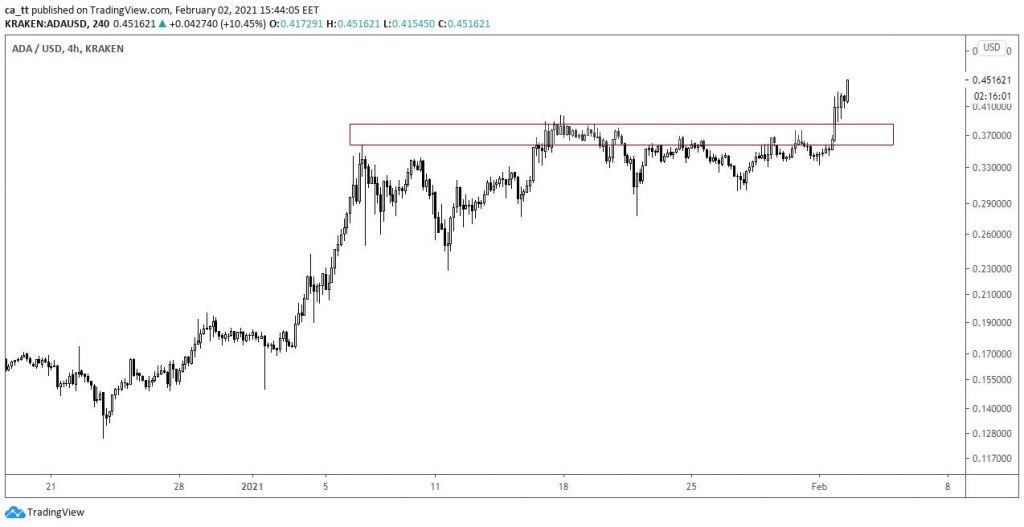

New all-time high: CARDANO chasing the dollar

Cardano (ADA) is literally out on the hunt for the dollar.

The cryptocurrency rate is approaching the $ 0.5 mark. If the price breaks above this level, the next target will be found at $ 1.00.

In general, the Cardano chart is very similar to the ETH / USD pair's movement with just one exception: the price broke the resistance and continues to grow.

Analysts foresee a bright future for cryptocurrency. The Cardano blockchain is an improved version of Ethereum with a Proof of Stake consensus algorithm.

By the way, the Ethereum blockchain also switched to this algorithm in 2020.

Realistic scenario

The ADA token approaches the round $ 0.5 level, where bears start selling the coin.

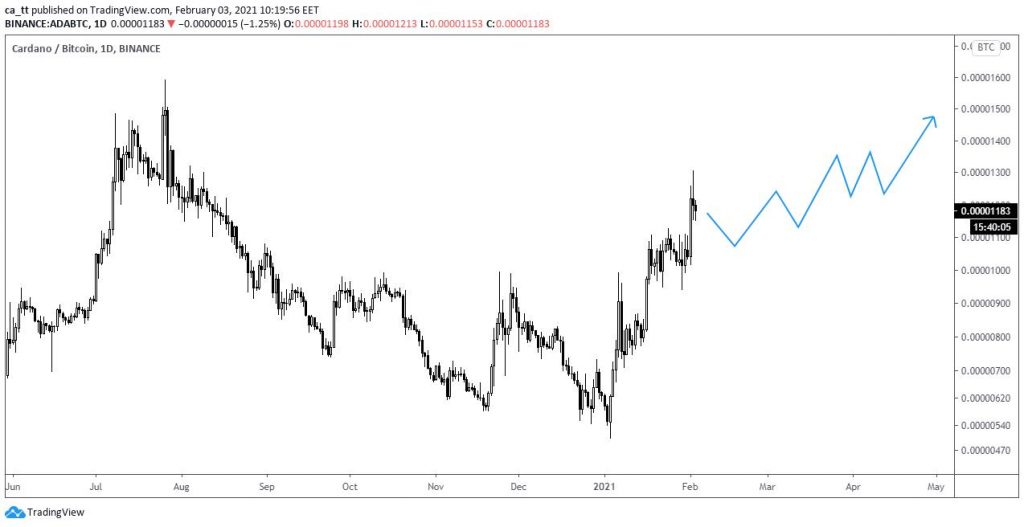

It's also worth paying attention to the ADA/BTC pair, which may rise by another + 15%.

Optimistic forecast

The most optimistic and highly favorable development is that the ADA rate reaches $ 1.00 mark in 2021-2022.

Yearn.Finance

YFI cryptocurrency is a very young and successful blockchain project.

Yearn.Finance is a suite of products in Decentralized Finance (DeFi) that provides lending aggregation, making sure that netizens get optimal profitability during their cryptocurrency transactions.

As an Ethereum-based altcoin, Yearn Finance is a DeFi lending protocol. YFI token maximizes the user's profitability by moving funds between different DeFi protocols automatically.

Today it is one of the most popular and decentralized projects in the cryptocurrency industry.

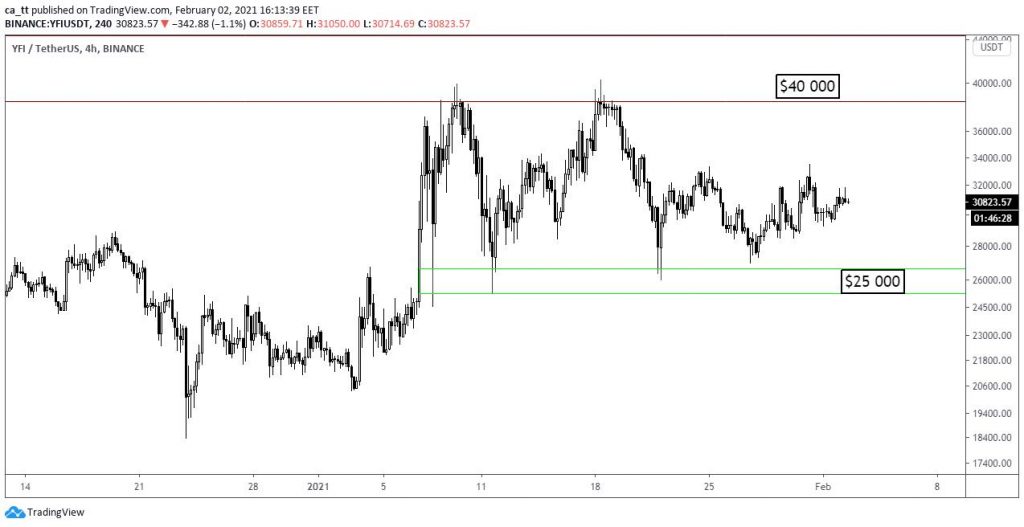

YFI is among the top 50 largest cryptocurrencies by market capitalization. It's already catching up with Bitcoin in price: the cryptocurrency is currently trading around $ 30,000.

YFI technical analysis

YFI/USD quotes are seesawing between the 40,000 and $ 25,000 levels:

Technical analysis indicates that bears are much stronger than bulls. The YFI will most likely test the $ 25,000 mark again, and isn't likely to renew its highs in the next six months or a year.

Investors should consider a short-term long near $ 25 000 level. The key demand is currently accumulating in the $ 18,000- $ 20,000 area.

3 simple trade ideas for altcoins

Seize the moment while bitcoin is sideways – invest in altcoins.

The world is now watching three assets:

- Ethereum, which froze at $ 1 500 mark

- Cardano, which is approaching $ 0.5 level

- And YFI, which is about to go down to the $ 20,000- $ 25,000 levels and become an attractive long.

Invest in key cryptocurrencies with amarkets. At the moment, we offer 7 of the most liquid cryptocurrencies:

- Bitcoin

- Bitcoin Cash

- Dash (Dashcoin)

- Ethereum

- Ethereum Classic

- Litecoin.

Open a live account and profit from the major altcoin trend.

Provided by AMarkets