EUR/usd

The market has again come to a standstill and to be on the safe side locked in profits after 8 days of growth. Today Bernanke gives another speech and expectations of this event are given extensive coverage in the press. First of all, it is caused by broad market movements in the opposite directions after the previous two speeches (the press-conference after the fomc's decision and the speech given in Cambridge on the occasion of the Fed's centenary). But that is not all – it turned out that Bernanke's speeches to the lawmakers usually provoke stronger fluctuations in the market than other speeches on average. What will this speech be devoted to? Most likely, the Fed will be ready to reduce bond purchases later this year if the economy will be recovering at the expected pace. Here two aspects are worth considering – firstly, the recovery may not meet the expectations, which is quite possible, and secondly, it is not necessary to stop bond-buying at once. For a start, the monthly volume of bond purchases may shrink from the current 85bln to, let's say, 45bln, let's assume, due to mortgage-backed securities. There are more reasons to render less support to the housing market than to stop bond-buying, especially while the budget deficit remains high (about 900bln). But this is all about the future. For now we have the following facts: eurusd yesterday rose to 1.3170 yesterday and was just a step form the highs of last Thursday. There are lots of signs of the uptrend, despite not very favourable statistics from Europe. Now, at the Asian session, the pair is retracing down, but it should only intensify the bulls' pressure. Yet, selling of USD and US stocks is apparently needed for that.

GBP/USD

The pound is a weakling and if it goes on like this, it will lead the camp of losers of the year instead of the aussie. The reason for that is in the expectations that the BOE's head Carney will take active political measures, which will ease access to lending in the country and therefore will put pressure on the sterling. Yesterday's inflation statistics ( proved to be worse than expected and below 3% y/y) only contributed to this. The pound/dollar is trading sideways and this is against the background of the global weakness of USD since last week. The employment statistics and the MPC's meeting minutes, which are to be released today, may provoke stronger decline as both the events bear risks of the downtrend.

AUD/USD

The Aussie, without any fuss, taking advantage of the even demand during the day and weakness of USD-bulls, on Monday-Tuesday managed to show the best two-day growth for the last two years. The pair is now at 0.9230, although last Friday it at some point dropped below 0.9000 for a while. The index of leading indicators in the country keeps growing, though the yearly rate from the impressive 5.4% fell to 4.9% in June (it's been above the long-term average level of 3% already for the last half-year). The creators of the index assure that this is the expected rate of the economic growth for the coming 3-9 months.

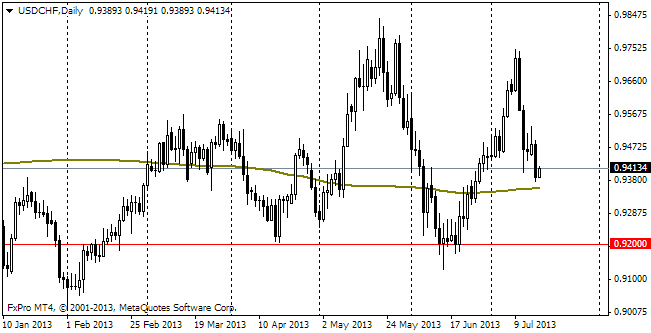

USD/CHF

Since the last week the franc has felt quite well, first of all, due to weakness of USD, secondly, because investors again have to consider the question about alternative safe assets. Besides, the franc had the potential for growth, as against the euro it rose to 1.2459, which is much above 1.20. Thus, USDCHF has every chance to go to 0.92 in the coming days.