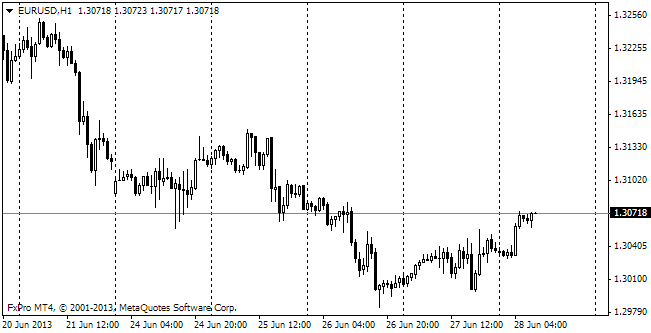

EUR/usd

As had been supposed, there was no important news on Friday, so the market was in the profit-squeeze mode after quite a good rally earlier in the week. During the correction eurusd fell from the area around 1.34 (Thursday's high) down to the levels below 1.3320 (on the opening of this week's trading and now). To some extent the modest performance of the single currency can be explained by weakness of the Asian exchanges, which have dropped down to the six-week lows. Actually, there's nothing left for EUR to do but react to the information coming from the outside, as there are no important news releases scheduled for today in the region. In this connection we may witness further downward correction in the pair. It won't be a surprise if already before the end of the day the euro will test 1.3250. Anyway, on the whole we still stick to the medium-term bearish sentiment against the dollar as we believe that the difference between the economic performance of the USA and the euro zone will be narrowing further in the coming weeks and months, which will make the probability of the stimulus extension by the ECB less. Besides, the periphery, gripped in a vice of austerity, will probably be able to show some improvement , which eventually may spill over into the reevaluation of the debt markets. The latter in their turn have quite a strong correlation with the single currency rate.

GBP/USD

Of course, having gone through a more impressive rally than the euro, the sterling also didn't manage to evade Friday's correction. On Thursday the cable was as high as 1.5570, on Friday it set the intraday high already at 1.5558 and today it's fighting already for 1.55. and in this struggle, as we think, bears have a better chance, despite the abundance of positive signals regarding the British economy, which we have been getting in the recent weeks. This day promises to be quite calm for the pound, but already tomorrow the situation should change. At the beginning of trading in London there will be a release of Consumer and Producer Price Indexes, which may affect gbpusd.

USD/JPY

Japan failed to impress the markets by its economic growth in the second quarter. Despite the expected growth of 3.6% (the annualized rate of the quarterly growth) the economy grew by 2.6%. Anyway, it is too early to see failures of the Japanese policy in these indicators, as the CB has barely got down to stimulation. The only serious support to the growth now is the currency rate, which at the beginning of the considered period had been falling down and only by the beginning of July had stabilized.

AUD/USD

The break in the dollar's decline has told badly on the aussie's performance. The latter has been trading at 0.92 since Friday, being unable to take the offensive due to the strength of the dollar. It should be mentioned here that in the near future there won't be so many releases on the Chinese economy, so traders in the coming days will switch over to the Australian statistics, which may impede further growth of the Aussie.