EUR/usd

eurusd was carrying itself well for the most part of the day and only during the US session it began to pull back. As was mentioned yesterday, the euro and the dollar are seen by investors as equally safe before the threat of Russian intervention into the Ukraine. Although in long term the euro is negatively affected by the crisis in the East, in short term the pair is primarily influenced by the economic statistics of Europe and the USA. Yesterday Final Manufacturing PMI for the eurozone was released. Its rate proved to be a bit higher than the preliminary one, but still met the expectations. The German and French indexes came out a bit above the expectations, while the Italian and Spanish ones were revised down. In our opinion, the current situation is not surprising. Independent Germany and France have all necessary resources to live through the current rate of the euro, while the troubled countries, which are now trying to rebalance the economy by means of exports, suffer the whole burden of the appreciating euro, the highest one for two years and a half. A bit later a similar business activity report was published for the US. The final rate proved to be the same as that of the European index, but actually that was better than expected. In January the USA suffered business slowdown, which was initially connected with the weather. Yet, strong evidence of business slowdown forced to treat it as more serious. We hope to get a better picture after the release of employment stats on Friday. Anyway, already now it is clear that manufacture again looks more optimistic in regard to growth. Eventually, it may support the dollar this week.

GBP/USD

The British manufacturing sector looks at the situation with much more optimism, mainly due to the base, built by the low pound in the previous years. Even the British press, known for its skepticism, write about the return of manufacturing sites back to the country after long years of outsourcing in the countries with cheap workforce. Yet the correlation of the British currency and stock indices is still strong. The problems of the latter didn't let the pair close the day positive, despite PMI's growth from 56.7 to 56.9 and a new multi-year high in mortgage approvals in January. The pair is now trading at 1.6650, 90 pips lower than a day ago.

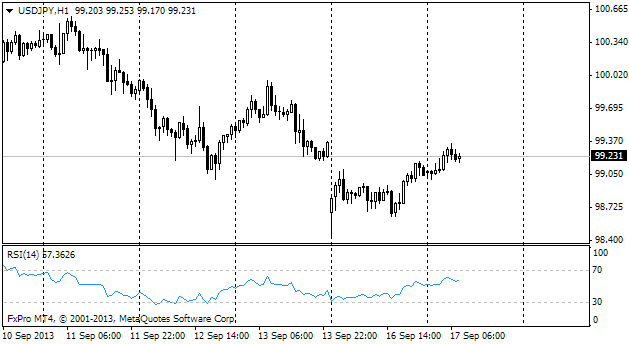

USD/JPY

The yen grew to the monthly high against the dollar yesterday. Today the markets are quiet, which allows for correction of the positions. The Japanese yen is being sold, though usdjpy is still below last week's close. The bulls should be careful. Closing of the gap (101.80) may bring the growth impulse in the pair to naught.

AUD/USD

The RBA preserved the general interest rate at 2.5%. It is quite an expected decision, in the meantime the market's interest is turned to the commentaries on the rate. The commentary on the decision again marked that the Australian currency remains high as compared to the historic standards. Yet, it's noteworthy that in its expectations the RBA mentioned acceleration of the economic growth and stronger activity in the construction sector. In our opinion, the attempts to put pressure on the Aussie because of the commentary on the rate decision are unfounded (the commentary contains more positive aspects). Selling in the Australian currency is more connected with the risks posed by the situation in the Ukraine. But even here in medium term increase in prices of gold and metals may support the Aussie.