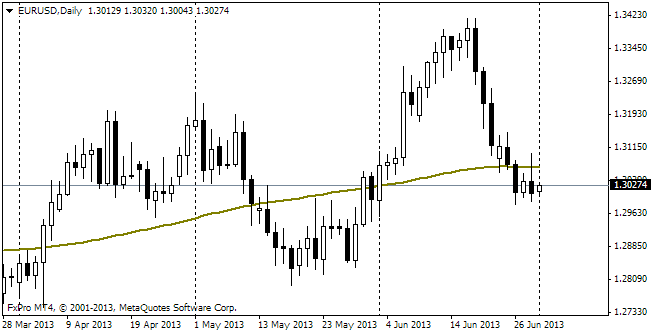

EUR/usd

As could be expected, trading crossed the bounds of the narrow range, thus arousing strong volatility in the currency market without any particular reason. The euro purchases had led the pair from 1.3320 to 1.3450 by the beginning of the active US session. Thus, the pair entered the area of half-year highs, going beyond the peak of June 19, which made 1.3420. It is also remarkable that this movement was not immediately followed by a retracement. Up to now trading is held above 1.34, which speaks about strength of the bulls and inspires hope for further growth. Anyway, the picture may prove to be just the opposite. It cannot be excluded that real bears are simply standing aside, waiting for the Fed's minutes to launch a large-scale attack. In this case, growth of the dollar in the recent weeks will look like nothing but a mere correction of the preceding growth in DXY and an attempt to reach new multi-month or even multi-year highs. If we look beyond the pair, we'll see that the market is getting ready that the Fed will take its foot off the gas pedal soon. It shows itself in the suffering of the currencies of the developing markets. They are losing their relish in the eyes of investors against growth of yields of more reliable bonds from the developed countries. The developing markets, now facing slowdown of their own economies after the global financial crisis, are no longer that attractive for investing. To no small degree, the governments of the developing countries themselves are to blame for this, as they have restrained the capital flows too much in the previous years. The developing markets should again realize that to attract money and support growth of their economies they have to fight for investors' money.

GBP/USD

The sterling keeps putting on weight against the dollar, but has become more modest in comparison with the euro and Swissie. Yesterday the cable managed to come very close to 1.57 ( the high is at 1.5694), but soon went on the defensive, now remaining at 1.5660. In the meantime, GBPCHF lost three fourths of its growth last week and returned to 1.4350 after the peak of 1.4590 at the end of the previous week. In much the same way EURGBP turned in the opposite direction, being already as high as 0.8570 from the bottom of 0.85.

AUD/USD

The aussie keeps suffering losses. Now it is again close to 0.9000 and, what's most alarming, this is happening against of the general weakness of the US currency, which has been described earlier. So, it looks like the Aussie has lost the status of a growth currency, but failed to secure the status of a protective asset and for the most part resembles in its behaviour the currencies of the developing countries, it means suffers the lack of interest. This attitude of investors to the currency of the country whose exports depend directly on production in the developing countries is pretty understandable.

oil

Weakness of the dollar left the commodity markets, Oil in particular, unaffected. Its price has fallen by $3.5 since the end of the previous week. But, what's more alarming, the current turn from growth to decline has been the third one over the last month. The levels above $107/barrel remain unsteady. The revival of consumer activity still lags behind extraction growth and improvement of energy efficiency indicators.