EUR/usd

Yesterday's session, which didn't abound in macroeconomic news releases, let the pair remain close to the weekly open for the most part of the day. Only during the hot US session players have expressed their desire to correct the growth. And before that the pair had hit the high at 1.3385. The news coming from the USA still prove to be slightly worse than expected. For example, yesterday it became known that industrial production had grown by 0.4% in August, which is worse than the expected 0.5%. The annual rate makes 2.7%, which is much weaker than 4% at early 2012 and even less than 3% a year ago. On the one hand, such news let dollar-bulls be sure that the Fed will taper bond-buying (the market is waiting for the reduction of treasury bond purchases). On the other hand, dollar-bears in their turn can call attention to the clear signs of the damping impetus, pointing out that weaker support may seriously hamper the economy. It's worth mentioning that earlier expectations of the stimulus rollback from the Fed were quite frequent, but in a few months they changed into the need for another portion of incentives. Of course, there is a risk that the improvement is still too feeble. We've spoken about it before, supposing that curtailment of the bond-buying programme will start at a later date.

GBP/USD

During the active European session the pair tried to start growing. It even hit a fresh local high (1.5962), but then stumbled over the persistent bearish pressure. Players seek to fix their profits before an important meeting of the Fed. However, today's agenda abounds in important domestic statistics for Britain. These will be consumer inflation, producer prices and also the official (much lagging) home price indicator. So, be careful with the cable, it can spring surprises today.

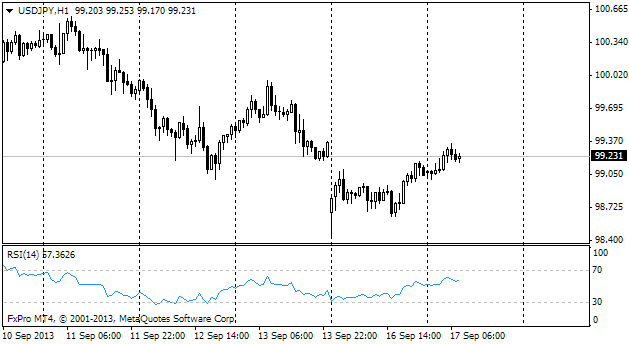

USD/JPY

The yen was one of the first to compensate the losses it had inflicted on the dollar at the beginning of the week. Trading is now at 99.30 as market participants seek to correct their positions after the growth of stock exchanges on Monday (this correlation is still very strong). In our opinion, this upsurge of the pair is not very surprising as there are lots of traders who will be glad to get rid of the yen against growing risk demand and tireless work of the printing press, launched on Abe's order. At the same time till October we don't expect any new highs in the pair, as it would indicate a too sharp decline against the levels of the previous year.

AUD/USD

The Australian CB hasn't eased the bearish pressure on the domestic currency. Against the expectations, the published minutes have showed that the RBA still reserves an opportunity for the rate cut in the near future. Besides, the minutes have mentioned that the further decline of the currency rate is able to support the economic growth in the country and make up for the impact of the ending resources boom. However, we can't say that this declaration made the Australian currency weaker than others. Probably, only against the Kiwi it suffered some losses. The aussie is now prone to the general trend to decline against USD with the purpose to close the gap of the beginning of the week before tomorrow's release of the Fed's decision. The pair should go down by another half a figure from the current 0.9290 to return to last week's close.