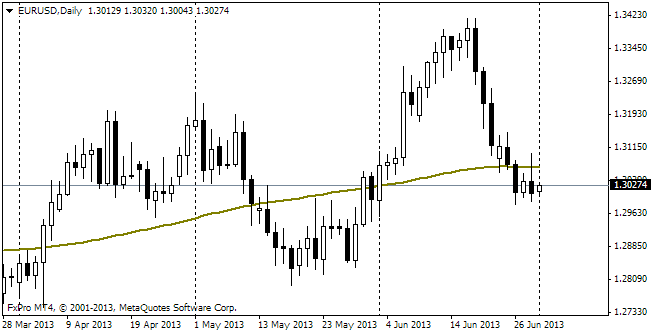

EUR/usd

Albeit with a certain delay, the markets seem to get imbued with the realization that the stimulus rollback won't take place as soon as supposed before. Against this background money has again started flowing into risky assets. More so, some agitation can be observed in the developing markets as well, which in its turn helps commodities and commodity currencies. In general, the dollar is depreciating across the board. EURUSD was on the rise all through the day yesterday. And if before the beginning of the active Asian session growth hadn't been very fast, afterwards it picked up speed. As a result, from the daily open of 1.3161 the pair grew to 1.3280. At night it retraced a bit and is now trading at 1.3170. EUR managed to rehabilitate itself even against the pound, recouping some of the losses inflicted in the previous days. However, the most important thing achieved was the rise above 200-day MA, with confident candlesticks on the payrolls release and on Monday. Taking into account that now money is coming back into the markets, this fact can become a very useful argument in favour of the further selling of the dollar in the coming days. Of course, it is still doubtful if the pair is strong enough to grow above 1.34 and higher, but it's quite likely that we'll see a movement in this direction in the near future.

GBP/USD

The sterling wasn't standing aside either, putting on weight against the US dollar. The pair managed to break through 1.5700, finding itself much closer to its resistance than the euro. Earlier GBPUSD was twice pushed down from 1.5700, yet now bulls are supported by the fact that the pair is above its 200-day MA and by a series of positive macroeconomic news for Britain. Anyway, don't think that this level will be given up without a fight. To some extent, profit-taking before the important level is one of the reasons for weakness of the pound against the single currency.

USD/JPY

The pair hasn't even closed the gap, formed on opening of this trading week. It is quite likely that in the near future we will see another attempt of the pair to go above 100 on optimism of the Japanese stock markets. Here we prefer to be cautious as we suppose that hitting of this level may entail profit-taking or even without this hitting stock exchanges, which have grown much in the recent days, may develop correction.

AUD/USD

Yesterday we didn't say about elections in Australia. Labourites have again returned to power. Such rotation is a common thing for the countries, suffering economic weakness. The elected coalition confirmed its intention to realize its election campaign, consisting in stimulation of consumer demand and reduction of public spending. Also, we shouldn't forget about the efforts of the CB, which cut the rate to the historic low in the previous months, which made lending more accessible. As a result, NAB Business Confidence rose to the highest rate over the last two years (+6 against -3 a month ago), though historically its rate is far from the highs. The aussie successfully broke through 0.92 and in the morning it even rose as high as 0.9290, yet for the further growth there should be a serious reason.