EUR/usd

euro-bulls were disappointed. Those, who bet that the ECB's differences wouldn't let Draghi continue with policy easing, proved to be wrong. Yes, we also were of that opinion, so a sharp drop of the single currency from the current levels proved to be a kind of surprise to us as we had expected some consolidation near 1.2500. Besides, the US employment data, which initially had passed unnoticed, again exceeded the expectations. The number of weekly unemployment claims had shrunk by the beginning of November to 278k. Moreover, the number of continuing claims decreased dramatically and hit a multi-year low yesterday. In this connection it is not surprising that the euro was under pressure during the ECB's press-conference and that the dollar was growing against other currencies and assets in the further trading hours. eurusd had tumbled down to 1.2363 by the beginning of the day and later was stabilizing near 1.2380. The market participants, which had drawn up their forecasts mostly by the beginning of the week, suppose that average employment growth will make 289k. However, higher rates won't be very surprising in view of the employment growth by 230k just in the private sector, as reported by ADP. Considering the fact that the US population is getting old and gradually abandons the workforce rows, there shouldn't be any unexpected changes in the unemployment rate. The latter will either remain unchanged at 5.9% or will slightly go down. Special attention will be paid to earnings growth rates today. They are obviously a weak link in the current recovery. Although the federal reserve is sure that strong employment rates pose a threat of earnings hike and inflation, there are reasons to doubt it. Inflation growth can find an obstacle in the strong dollar and heavy decline of commodity and energy prices (much heavier than growth of USD). Apparently, the single currency will head directly for 1.20 – the preceding important support level.

GBP/USD

pound-bulls were trying to combat the pressure of the US dollar for a while. Anyway, the dam was broken. The cable failed to catch at 1.60. During the day it fell down to 1.5830 and at the beginning of the Asian session hit a local low of 1.5815. It is the lowest rate since September 2013. The sterling, unlike the euro, doesn't have any consolidation levels within the reach. Should the BOE remain dovish and the dollar continue its vigorous attack, the pair will be able to hit 1.50 before it is on firm ground. However fundamentally the British economy feels better than the eurozone, so, in our opinion, it is more reasonable to expect consolidation near 1.6000.

USD/JPY

Some profit-taking before the EU session yesterday didn't impede the pair's growth. Traders keep purchasing the pair, raising it above 115. It is unbelievable, but for less than a month the pair has grown by 10 figures. This seemed to be impossible especially in July after 7 months of flat trading. And since then the pair's gains have totaled about 15 figures. Our favourite measure of comparison of the current rate with that of the previous year shows growth by 17%. It leaves some space for further growth of the pair. 120 by the end of the year is quite possible.

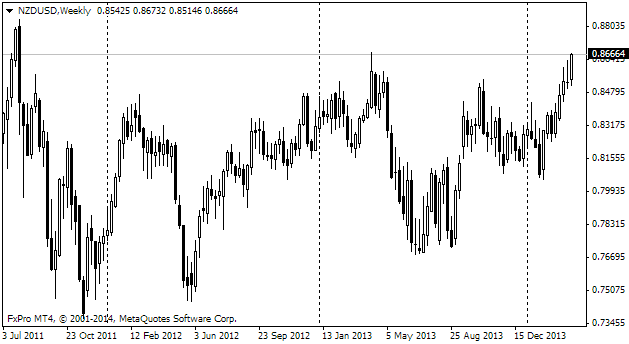

NZD/USD

The New Zealand Kiwi fell below 0.7680 yesterday, which is below the lows of the previous year (0.7700). Hence the nearest target of decline can be set at the lows of 2012, when the pair reached 0.7450.