EUR/usd

The US dollar managed to preserve its positions on Monday. For eurusd absence of motion can signal that bulls are moving up fresh reserves. The pair needs a break as technically it now looks overbought or quite so, depending on the technical indicator considered. In the meantime, the American currency, taking advantage of the opportunity, has been gathering momentum at other ‘fronts'. Stock traders decided to take their profits. The optimism, aroused by the employment statistics, didn't last for long. To stir some considerable selling in the euro and stock exchanges we need a serious reason, but as we go forward it will be harder and harder to find a good reason for buying. Growth generally takes place when statistics surpass expectations and now the expectations seem to be quite high. The Fed and the government have given quite optimistic estimates of economic growth for the current and next years. Though we've often seen that the market may follow the preceding trends for a long time before venturing a reversal, we still think that now the movement is following the beaten track and is not steady. Returning to the employment statistics, published on Friday, it should be mentioned that jobs growth proved to be above the forecasted rates, while the unemployment rate, on the contrary, increased. In February employment rose by 175K (against the expected 151) and unemployment grew up to 6.7%. These rates are calculated in different methods, so some deviations can happen here from time to time. Upon the whole, the current situation in the labour market doesn't pose a threat to another stage of tapering, which is expected in the middle of the next week.

GBP/USD

The pound suffered liquidation on Monday. Its weakness has manifested itself since last week, when it was lagging behind the euro in its growth against USD. On Friday, as a result of the reaction to the payrolls release, it closed the day below the daily open, but yet above 1.6700. And yesterday it went through massive selling, which was spurred by the comments of the Bank of England Deputy Governor that the expensive pound would hardly help the recovery and could hamper the exports. Also Bean made it clear that the markets shouldn't expect high interest rates, the way they were before the crisis (above 5%). From his words it followed that they may count on 2% in the coming three years.

USD/JPY

The bank of japan didn't change the policy at the last meeting. In their comments the Bank expressed less concern about exports (which is very unexpected after the poor performance last year and the terrible report in January). It is clear that the Bank is considering the prospects, which have become more optimistic in view of abundant profits of Japanese corporations and growth of business activity. But it should be borne in mind that Japan imports a lot of energy and other commodities, which become more expensive when the Japanese currency depreciates. The rejection of nuclear energy only aggravates the situation. So, our reasoning leads us to the conclusion that the BOJ is likely to bring in another portion of incentives, which will eventually weaken the yen, albeit at a moderate rate.

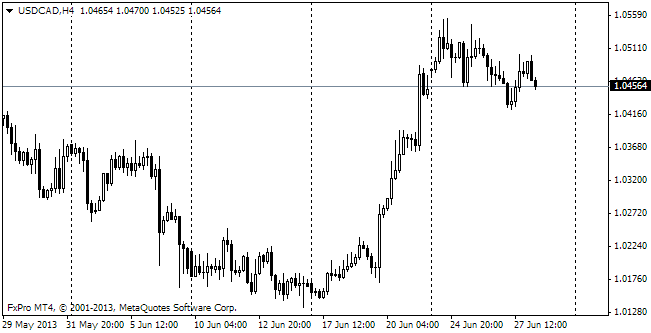

USD/CAD

The Loonie suffered on Friday due to the divergence between the employment reports of Canada and the USA. Despite the stability of unemployment, employment decreased by 7K instead of the expected growth by 17K. The situation is not that bad, in our opinion, as the decrease affected mostly the part-time employed. Besides, the trade balance has become more balanced: -180bln in January against the expected deficit of 1.6bln and the deficit of 920bln in January.