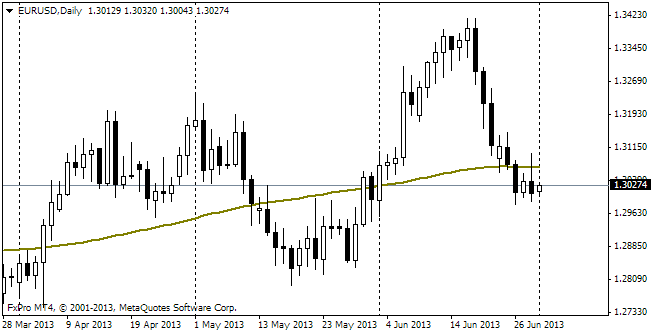

EUR/usd

As befits a central banker, Bernanke made it clear that his previous remarks were understood wrongly , which immediately put USD under pressure. What started as small profit taking after hitting three-year highs by the dollar index took a turn for full-fledged selling of the US currency. Yesterday the Fed's head noted that the US economy needed the soft and stimulating policy to be preserved in the foreseeable future. These words gave rise to a rally. Soon it got additional support on triggering of short positions. The move was so violent that eurusd hit 1.32 after the daily low of 1.2762 on Wednesday. We can hardly recall the last time when the pair performed such a great move for less than a day. Yet, it should be mentioned here that in daily charts the rally is stretched out for two days, which makes it less impressive. With a decisive move the pair again found itself above the 200-day MA, which should support the bulls. The threat to the further growth in the pair is posed by instability of the euro zone. The regional statistics haven't been very impressive lately and the issues in the periphery are again pushing the bond yields up. Today it's worth being on the alert when Buba's Weidmann speaks. Besides, we can't exclude that the market will want to drop EURUSD below 1.3050. Yet it is also clear that yesterday's speech of the Fed's chairman may set the trend for the coming days and weeks and also inspire euro-bulls with the idea that the pair may break through 1.34.

GBP/USD

USD selling against the pound was slightly less picturesque – pay attention to growth of EURGBP – but there are some reasons for joy. The sterling is again back above 1.50. At the beginning of the Asian session the pair stopped a step away from 1.52, having hit only 1.5190. Now trading is held close to 1.51. The British pound is very far from its 200-day MA, and so is the country's economy – from the acceptable levels. Anyhow the pair managed to come off the lows and even break the steep downtrend. Thank you, good Bernanke!

AUD/USD

The Australian currency, which had been doing well before, was also carried away with a tide of euphoria. Against the background of purchases in the pair, traders have almost ignored unemployment growth to the highs of 2009. Only growth of the general employment rate beyond expectations was noticed (10.3K against 0.3K), but even here it happened due to the part-time employed (+14.8K) instead of the full-time employees (-4.4K).

gold

It looks like Gold also gets its chance, at least of a recovery. This precious metal has used this chance to get closer to 1300 (now 1292). Anyway, even being $100 away from the lows this instrument has good potential for growth.