EUR/usd

USD doesn't feel like leaving the gained positions for long, but at the same time it is not strong enough to go further. For now. Some improvement seen in eurusd on Monday was leveled down by the decline on Tuesday. It is remarkable that there was no bad news from Europe. The markets simply fear dovish comments that draghi can make at the press-conference tomorrow, hinting at taking action in December. Strong advocates of active measures call on the CB to loosen lending standards already in November. The latter is hardly possible. Yesterday Mario Draghi pointed out that the EU affairs were getting better. Apparently, it should be treated as unwillingness to ease the policy to do an about-turn in it in the coming few months. On the other hand, even relatively optimistic official forecasts do not promise any significant improvements in the region. Yesterday Eurocommission revised down the expected economic growth of the eurozone in 2014 from 1.2% to 1.1%. Such figures show that we shouldn't expect an inflationary surge and high lending activity even if the CB gets a bit milder than usual. It's true that the current policy is unreasonably tight as lending remains a weak link of the recovery. Tougher regulation only aggravates the situation as it forces banks to build up their reserves instead of giving loans to corporations and households. Yet the USA somewhat surprises with its steadiness in October. Yesterday's nonmanufacturing statistics proved to be better than expected and even showed some stronger growth as compared to September. ISM Non-Manufacturing PMI has grown from 54.4 to 55.4 in November against the expected drop to 54.2. ISM Non-Manufacturing Employment Index also has performed well, having grown from 52.7 to 56.2. But for the disappointing ADP data last week, there would be some grounds to expect favourable payrolls this Friday.

GBP/USD

The Services PMI surpassed the expectations. From the level of 60.3, which is already high, it rose to 62.5, showing that the British services sector is growing fast and continues to gather pace at the end of the year. On the release of such news the sterling flew from 1.5950 up to 1.6060 and this morning it continued its upsurge, growing already to 1.6090. Now it only remains to get manufacturing statistics to understand how clearly the sentiment indices reflect reality this time.

USD/JPY

Strong markets are to the advantage of USDJPY, which is again trying to get closer to the highs of the beginning of the week (near 98.80). Taking a broader look at the situation, it is easy to notice that the trading range of the pair is getting narrower. The picture resembles a triangle, though for a classic technical pattern it has too many hits of the borders.

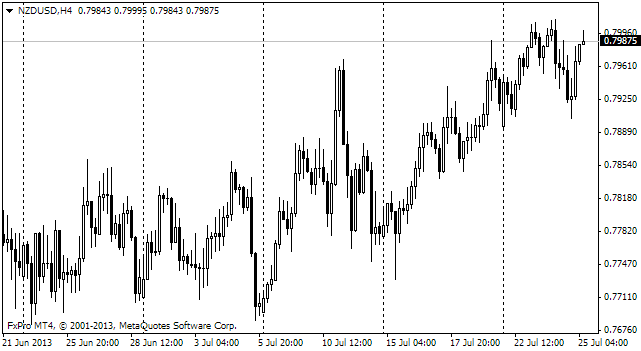

NZD/USD

New Zealand has something to show besides the optimistic mood of the RBNZ's head. Last week he wasn't against the strong currency and only said that its high rate would enable to put off toughening of the policy. Today's quarterly employment data proved to be much better than expected. Over the quarter employment grew by 1.2% and over a year – by 2.4%, the average hourly earnings jumped by 1.6% and the participation rate to 68.6% (for comparison in the USA it is lower by 5.4%). The Kiwi continued growing and rose against the dollar already to 0.8380, thus recouping half of the losses incurred in the previous week and a half.