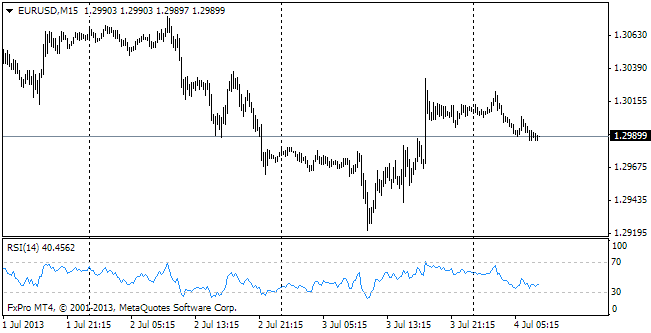

EUR/usd

a bit better – here the index is on the rise – but in this country as well it has been speaking about slacker activity for two years. It was much more unpleasant to learn about the downward revision of the German PMI – from 51.3 to 50.4. This news put considerable pressure on the single currency, which during these publications plunged from 1.2980 to 1.2920. However, the initial bounce changed into more confident performance of the single currency first on the favourable retail sales statistics for May (+1%) and then on the US statistics. ADP published the data on employment in the US private sector. It was reported about growth by 188K, which is more than expected, but still not enough to speak about sure improvement. The same situation is with unemployment claims. Formally, the statistics proved to surpass the expectations: the number of unemployment claims reduced by 5K to 343, yet the 4-week average is now at 346K, which is not much different from 348K, which was reported at the end of May. That the USA doesn't demonstrate any magic speed-up we saw on the release of Non-Manufacturing PMI by ISM. From 53.7 it dropped to the lowest level since February 2010 – to 52.2 against the forecasted growth to 54.3. Altogether these news releases have provoked depreciation of the dollar (eurusd closed out the day above 1.30), but also let the stock exchanges close positive, which looks strange enough considering the poor statistics.

GBP/USD

Britain managed to overcome the pessimism of investors yesterday. First of all, they didn't sell the pound on the poor PMI statistics for Europe and on the release of the domestic Services PMI it became pretty clear that the Continent has no chance to keep up with “the Old Lady”. GBPUSD rocketed from 1.5130 up to 1.53 by the end of the day on the message that the index had grown from 54.9 to 56.9. This indicator has been in the uptrend since last December and in the last two months it has shown even faster growth. It is already a sound argument against active steps to stimulating the economy by non-standard means. Probably, Carney will prove himself, but not today.

USD/JPY

Profit-taking, against which we warned the bulls, happened yesterday. Against the background of the weakening dollar the yen felt much better than the overwhelming majority of currencies (perhaps, with the exception of GBP). Over a few hours usdjpy tumbled down from 100.70 to 99.30 and is now consolidating a bit below 100.

AUD/USD

Yesterday's selling of USD helped the aussie to offset the morning losses, caused by the speech of Stevens and the afore-announced readiness of the CB to search for other ways to stimulate growth besides the mining sector. Today the pair is a bit above 0.91, more likely, having taken a break with new extremums, at least before the release of the payrolls.