EUR/usd

New home sales in the USA dropped right by 13.4% in July. That unexpectedly sharp decline gave rise to dollar selling in the second half of Friday's trade. eurusd flew up by half a figure to 1.3400. That was the third attempt to break through that level for the last three weeks. The first attempt was in the first decade of August – then the pair just touched that level. And the other two tries took place last week, yet each time the pair failed to consolidate above those levels. At the moment trading is held at 1.3380 and the pair will hardly shift much in the coming hours against low trading activity. The thing is that there are no important events on the EU's agenda today and in Britain (the financial centre of Forex trading) there is Summer Bank Holiday. The only news that is worth noting is the release of Durable Goods Orders, which have grown by 13.5% over the last trimester. It is a significant growth, so today's release is expected to show a 3% correction. If the correction is stronger, the dollar may again be vulnerable to bears' attacks as traders will continue reconsidering the probability of the stimulus rollback in the near future. In this regard, the housing market is a serious indicator. For this reason the dollar shifted much on the release of new home sales statistics. We've been pointing at a very fast growth of activity in this sector for a long time. But now we have to admit that July's slowdown looks quite severe. Firstly, for the first time since January 2012 the growth rate of this indicator dropped to one-digit figures. Secondly, decrease in sales coincided with the price drop. In July it fell by 0.5% to 257.6K and from April's peak – by 8%. There is another observation: over the last months the gap between the number of housing starts and new home sales expanded. Under normal conditions housing starts were rarely twice as much as new home sales, but in the recent months home sales have been three times as few as housing starts. That was last seen in 2007/08, when the mortgage market was sharply falling. In much the same way the number of unsold homes in the secondary market is also growing. The ratio of reserves to sales grew from 4.3 to 5.1 at the beginning of the year. This ratio shows how many months will be spent to sell out the current reserves at the current sales pace.

GBP/USD

The sterling was moving up and down on Friday, but remained approximately at the same positions, that is at 1.5570. Once again the problems with the US economic growth tell negatively on the pound's performance. Anyway, we still don't see any clear signals of either growth or decline. More likely, skeptics will prove to be right and the pound will slide back to 1.50, but it is an open question yet.

USD/JPY

All through this week attention of market observers will be riveted on the Japanese debates regarding sales tax increase. Increasing this tax Japan is going to make up for the decrease in the corporate tax. It is an indispensable measure since for many years there has been a huge gap in the Japanese budget.

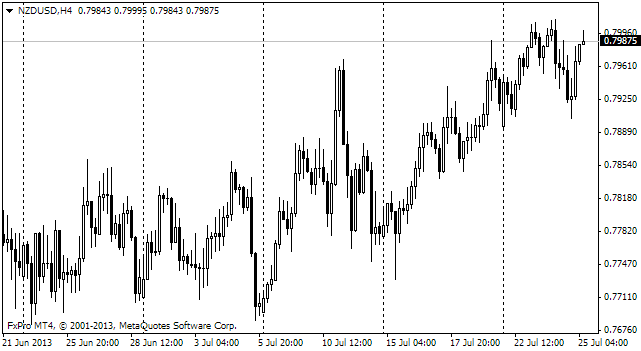

NZD/USD

Despite all its problems, the Kiwi seems to be strong enough to restore its positions this week. The pair was supported at 0.78 ( the low was at 0.7760): bears are taking their profits after quite a successful week, when the pair dropped by 4 figures from 0.8160.