EUR/usd

The S&P 500 BMI closed Tuesday at the record-high level. This impressive performance was a result of the easing geopolitical tension – Russia and the USA seem to have started a dialogue, which promises a dialogue between Russia and the EU in the near future, and then between the former and Ukraine. At the same time we are getting good news from the US corporations. As expected, business activity is getting back to normal after the cold winter months. In the meantime, the EU statistics were not bad either. The data on the German labour market reflected another decrease in the unemployment rate, now to 6.7%, which is the lowest rate since the time of the German reunification. The number of the unemployed declined by 12K, which is a bit more than expected. The employment statistics for the entire eurozone surprised with the revision of the preceding months' rates from 12.0% to 11.9% and preservation of the current estimate for February. Judging by Germany, which published its statistics for March, this month will be also marked with the favourable trend in the labour market. The Final Manufacturing PMI was also published yesterday. And if Germany's index was slightly revised down, the one for France was on the contrary revised up and Spain's and Italy's estimates proved to be better than a month before. Generally, it enabled the index for the entire eurozone stay quite high at 53.0. The ISM Manufacturing PMI reached 53.7 in March, which is higher than the February 53.2, but lower than expected. As a result, the impressive rally in the stock exchanges together with the relatively good EU statistics let eurusd stay close to 1.3800 and even take some attempts to get higher. Today the main risk for the markets is posed by ADP statistics. Since it is clear that the Fed won't stop in its reduction of the QE programme, the market reaction should be definite: good news is favourable for the markets and the euro/dollar.

GBP/USD

Bad news caught up with the sterling. It was expected, though we thought it would happen earlier. The British Manufacturing PMI instead of the expected growth (it's true the consensus forecast predicted growth!) declined from 56.2 to 55.3. It's quite predictable with such an expensive pound and relative weakness of the eurozone. The pound was depreciating against the euro and the dollar, against the latter it fell to 1.6630, never fighting for 1.67. Well, probably, the Construction and Services PMI will provide short-term support in the coming days. Though you shouldn't count on this: the cable is very heavy close to 1.67.

USD/JPY

usdjpy keeps rallying. The growth of the US stock exchanges and easing of the geopolitical tension help the pair rehabilitate, sending it farther and farther from the support at 101.50. It seems that the new quarter, which brought fresh money together with portfolio rebalancing, contributes to purchasing. Trading is held already at 103.80 and should the stock exchanges further show positive performance, the attack of 104 may take place already today.

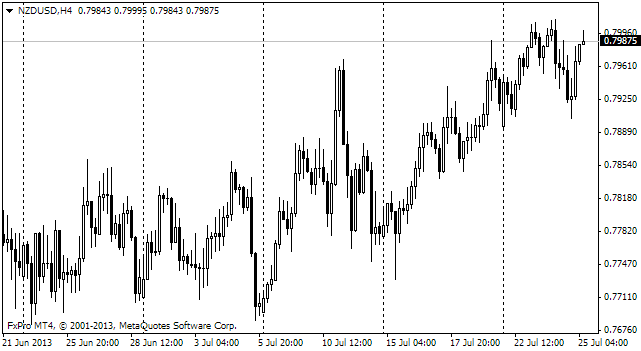

NZD/USD

The height at which the Kiwi is trading now makes it feel dizzy. The NZ dollar has been pulling back for two days in a row and has already lost over a figure from the recent high. It's quite possible that the downward trend will spread to the next few days due to the movement of funds between portfolios, where profit taking is quite reasonable even as a safety measure before the release of the US statistics. Just like with the sterling we think that the NZ dollar is at unsteadily high levels, which don't allow these currencies taking advantage of risk demand.