EUR/usd

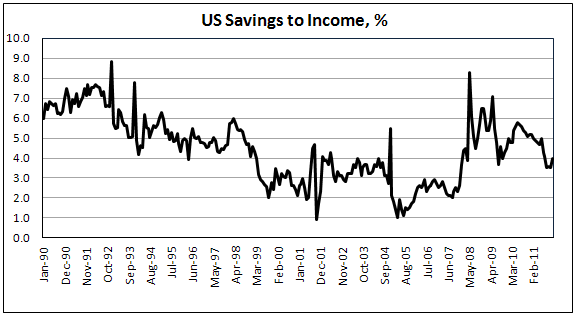

25 of the 27 EU countries signed the pact over toughened fiscal discipline. Along with Britain the Czech Republic also refused to put its signature. This pact imposes semi –automated sanctions for overspending governments and brings these regulations to the level of national laws. Greek Prime Minister Lucas Papademos claimed that an agreement with private creditors would be reached before the end of the week. Exactly the same pledge had been heard many times before without its further accomplishment then. However, the markets are still able to react to the statements of European politicians. On Monday morning the single currency showed a significant decline from 1.3230 to 1.3080 on the claim of German Finance Minister Schäuble that the EU governments wouldn't suffer the losses similar to those inflicted on the private sector at the time and on his demand that Greece should give up control over its fiscal affairs to a EU budget commissioner, who would have the right to veto any fiscal initiatives that were not consistent with targets established by international lenders. In general, markets anticipated the real fight among the politicians. All the parties were actually on the edge of losing their patience. This week, especially the end of it, is going to be really eventful, not only due to Greece, but mainly due to the coming payrolls. But already now we can see quite interesting statistics from US. Spending remained unchanged in December, while Income grew by 0.5%. Americans chose not to increase their spending on the slowdown in price growth (formally, in December prices didn't rise). This allowed the saving rate to rise to 4% against 3.5% a month earlier, however, it's not much, a year ago the level was above 5%. Generally speaking, the savings of 3.5% -4.0% are more typical of the credit boom years. Can the Fed be triggering a new credit bubble instead of deleveraging?

GBP/USD

The British pound feels good on the growth in stock markets. Higher risk appetite is spurring the sterling, which on Tuesday morning almost entirely won back the positions lost on Monday and is already set to rewrite the monthly highs. As yesterday we still stick to the opinion that the pound looks slightly overbought at such levels, though the impulsive upward movement to take stops above 1.5770 or even 1.58 is quite possible. Today there won't be any vital statistics from Britain except for the data on lending. This half-dead sector which since 2008 has lost 8 billion in monthly volume of 10, is unlikely to bring any surprises. The market is closely watching the situation in Continental Europe, but at the same time it realizes that in the end Britain will enjoy a better state of affairs, already now being one step ahead on the way to the fiscal policy implementation.

USD/JPY

The yen kept rising yesterday and actually the demand for the Japanese currency exceeded all expectations. USD / JPY fell to 76.17 this morning, which was very close to the record lows set on October 30, when the pair reached 75.56, thus provoking the intervention by the Ministry of Finance. Market speculators seem to be trying to trigger another one in the near future. The risks of this happening will be really high if the pair slips below 76.0. With the euro /dollar it will be a factor causing the decline of the euro against the dollar. Obviously, it would benefit the country's exporters suffering from the extremely high rate of their national currency, which tells very badly on the competitiveness of local goods. Despite some progress in industrial production last month (+4% m/m) and an increase in the number of vacancies, unemployment is rising, having reached 4.6% in December compared to 4.1% in September.

AUD/USD

The aussie remains unconquerable. Having quickly overcome its Monday's weakness, the Australian dollar again broke into a gallop. Trading is now conducted close to 1.0650 after yesterday's collapse down to 1.05225. This incredible resistance of the currency is also backed up by improving business sentiment. NAB indicator rose in December to 3 against 2 a month ago. It is a small, but still important progress, achieved despite all unfavourable circumstances and events, which fell on businessmen last month. With the indicator being positive, it means that business circles increase production, which can improve the labour market dynamics. And this is really necessary at the moment. However, we remain cautious over the CB's decision next week; the Bank may lower the cash rate in response to slowing growth in China.