EUR/usd

The single currency finds it difficult to hold above 1.35. Wednesday's attempts to get back above this level turned into strengthening of pressure on the pair on Thursday. Yet, there wasn't any utterly disappointing news about the eurozone. The market participants should generally feel the difference between the US and EU statistics. If with the former we are trying to assess how strong the growth is, with the latter we just feel the pulse: if the patient is alive or not. It is also important to feel this difference in the commentaries of officials. Thus, ECB's Coeure reminded yesterday that the policy of the European CB aimed at softening of financial conditions. In the meantime, K.C. federal reserve president Esther George pointed out that delay in the stimulus rollback may shake trust in the Fed. Again we emphasize that these words didn't arouse any reaction in the market, they just confirmed the existing sentiment. The situation was pretty much the same with the news about further decline in the EU lending. In August it shrank by 2% y/y – this hasn't been seen not only for the whole period of the euro's existence, but also since 1992 when these statistics were first taken into account. Besides, the ECB's efforts in this direction are also tangible. M3 monetary aggregate is growing at the pace of over 2% y/y and this difference between the money supply and lending rate occurs due to replenishment of banking cash stocks in connection with the tightened regulatory requirements. And if the ECB needs to target at some other factor besides inflation (as is fashionable now), it apparently will be the growth of loans, which now clearly indicates tightening of financial conditions. The US statistics didn't create any particular mood. Unemployment claims remain close to 300K a week and the number of continuing claims is approaching 2.8bln. The summer surge in the housing market has quickly vanished. The Pending Home Sales Index showed growth by 2.9% in August against the peak of 12.9% in April and 8.5% in July. It is also true that it is so because of the strong growth at the same period of time a year ago.

GBP/USD

The sterling closed out the day above 1.60 yesterday. It's really noteworthy that the pair has been trading within the narrow range for six days already. The third reading on GDP has somewhat disappointed the markets by the revision of the annual growth from 1.5% down to 1.3%. But upon the whole nothing terrible has happened: as has already been reported, the economy grew by 0.7% in the second quarter. The longer the sterling remains between 1.60 and 1.61, the higher the probability of further growth to the yearly maximums (1.6340) is, in our opinion.

USD/JPY

The index of Japanese consumer prices keeps settling down in the positive zone. The data published last night indicated that the core index reached 0.9% y/y in August. Yet the fact that there wasn't any positive dynamics in Tokyo in September is a bit disturbing. The core inflation in the country isn't very reassuring either. With energy and food prices excluded, this index shows decline by 0.1% yearly. There are fears that the price growth has been caused mainly by closing of nuclear power stations rather than higher demand.

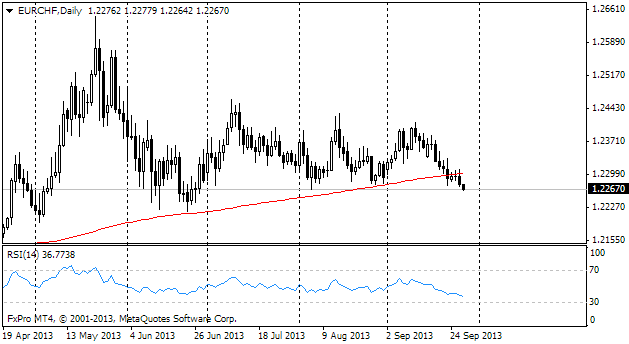

EUR/CHF

The rate of EURCHF is a good indicator of risk demand in the eurozone. Since the second half of the week it's been falling and has already lost a figure and a half over this time. Taking into account that there haven't been any significant shifts in the euro against the dollar, this movement looks rather serious. Now trading is held at 1.2260. Let's keep an eye at the support at 1.2240. Probably, selling started at these levels will be able to support appreciation of the euro against the dollar.