EUR/usd

Greenspan once said: “I guess I should warn you, if I turn out to be particularly clear, you've probably misunderstood what I said”. Despite all strenuous efforts of modern central bankers to develop targeting and establish communication with the markets, the results are still very similar to those at the time of Greenspan. Last month the markets reacted as though the Fed's head had made a U-turn in his policy during the last three conferences. His yesterday's comments to the Congress supported the single currency for a while as they said about the Fed's flexibility in using macroeconomic indicators in the monetary policy. In the phrase “unemployment should decline at least below 6.5% to start the stimulus rollback” Bernanke emphasized “at least”, so only when this term is fulfilled the Committee will consider possibilities to abandon the ultra-soft monetary policy. On this clarification the stock exchanges closed positive the ninth day out of the last ten ones. However, it wasn't of benefit to the single currency in the end. The growth of US stocks again made purchases of USD attractive. At the end of the day the pair was again pushed down to 1.3180, by a figure down, where it then stabilized. This day promises to be quiet as there are no important macroeconomic statistics to be released today and Bernanke will repeat his yesterday's speech, but now to the Senate Banking Committee.

GBP/USD

More than unexpectedly the sterling got support on the MPC meeting minutes. According to yesterday's minutes, the Committee unanimously voted for keeping the policy unchanged. The sterling shot up by over a figure immediately after the release and further during the day it was growing more intensively than the euro. Now the bulls have loosened their grip and the cable from Wednesday's high of 1.5270 has fallen to 1.5170. Yet we recommend being careful. The new head of the CB, most likely, is considering other ways to stimulate the economy, which may prove to be negative for the pound, as we get more and more evidence that usual expansion of the balance produces little effect on the economy.

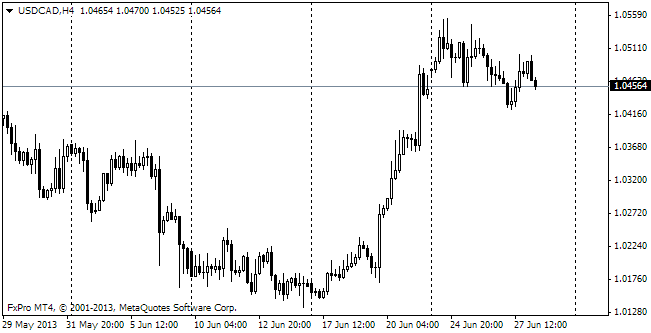

USD/CAD

The BOC also gave a clear formulation of its future policy yesterday. The rate was kept unchanged, as expected, but in the accompanying commentary we could notice some contradictions. The bank mentioned about the low inflation rate and insufficient level of economic growth, and it didn't forget about the imbalance in the housing sector. However, it also reminded that the current stimulating monetary policy wouldn't last forever. How did it affect the Loonie? In no way, a much stronger effect on the pair was produced by the remarks of the Fed's head, published before the rate decision.

gold

Gold also suffered a couple of unpleasant hours yesterday. Upon the whole, this year rallies in the stock market have told negatively on the rates of this precious metal. This correlation was in force yesterday, when the growth of stock indices gave rise to selling of Gold. The metal has come close to 1300 this week, but finds it difficult to break through this level. Bulls will have to be patient and wait for the full-fledged profit-squeeze in stocks for the rally to begin.