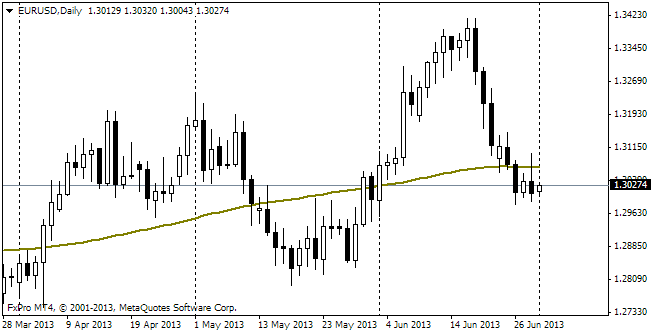

EUR/usd

Employment growth in the USA went beyond expectations in June and, as a result, caused a new tide of USD purchases. According to the released data, it grew by 195K, moreover, the growth rate in the previous month was revised up to the same figure (from 175K). April's rate was raised even higher – to 199K. Thus, the report and accompanying revision painted a picture of a bit more vigorous growth in the labour market. It was enough for the attack on the dollar to continue and bring eurusd to 1.28, where the trade stabilized. Now the trading range is still less than 20 pips – 1.2810-1.2827. America has made its contribution, now it all depends on Europe. We are waiting to see how a new round of negotiations between Greece and international creditors will be resolved. In the meantime, the meeting of President of Cyprus with the members of the ECB at the end of the last week, apparently, contributed to the press-release which said about raising of the debt status of the country due to observance of the terms, defined before in the bailout period. It should expand the list of assets constituting eligible collateral for the purpose of the Eurosystem market operations. Be careful as the further development of the situation depends on politicians rather than on economic indicators. The latter very often are more reliable and predictable. EURUSD fell to the support level of the end of May and now the bears may set out for 1.2750, where the pair was consolidating in late March.

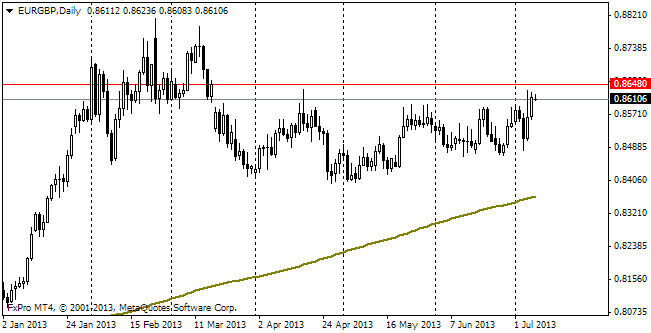

EUR/GBP

The sterling again suffered more than the euro. On the reaction to the payrolls it tumbled down to 1.4850 and the important support at 1.50 was broken already before the release of the US statistics. Due to this selling EURGBP is again trading above 0.86, having gone beyond the top of the trading range, observed since late April. Actually, the last time when this pair, which in general is inclined to trading within the range, rose so high was in April, for less than half a day. Then it failed to close the gap of March 18. So, the bulls may target at 0.8650, which is within less than 30 pips of the current level.

USD/JPY

Japan is getting closer to new elections, this time to the Upper House. Bloomberg has made an interesting observation that in 70% of cases the month before elections proved to be quite favourable for stocks (read , has provoked the yen depreciation), but then after the elections stocks in most cases reversed for decline (after 8 out of 10 last elections). It's very simple. This is right in the nature of Japanese politicians to make impressive announcements, which soon break against grim reality or impossibility to oppose the competing party.

AUD/USD

Last Friday the aussie didn't escape the general lot of currencies against the US dollar, yet audusd managed to avoid the new low. And it's already a serious bid for resistance on the part of bulls. Yet in the longer term be careful with the Aussie as the country's labour market, according to the ANZ's statistics, keeps losing the impulse. The number of job vacancies has been reducing for four months in a row. In June it was by 1.8% less than in May and by 18.7% – than a year ago.