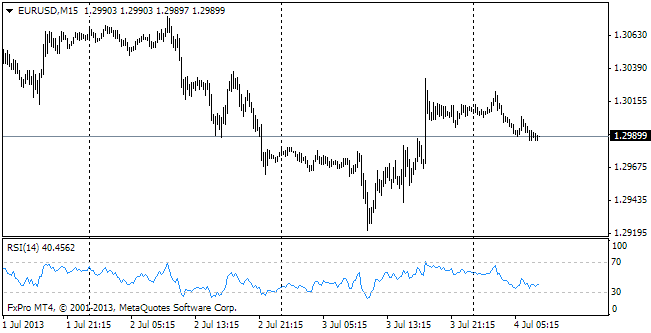

EUR/usd

The markets have again stepped into the period when correlations between key currencies and assets are not valid. For example, growth of developing markets is usually accompanied by growth of stock indexes of these countries and entails increase in commodity prices. Already for three months we've observed growth of commodity prices, but notwithstanding this fact developing markets and also resource-based Australia and Canada have been suffering a serious capital outflow. The same with the EU currencies. EUR has been depreciating for four days in a row and is already not far off 1.32, trying to break lower. Yet the markets are sending quite favourable signals. Sunday's statistics on Chinese Manufacturing PMI have indicated faster growth in the Celestial Empire in August. This news was enough to stir growth of US stock index futures and support growth of Asian markets on Monday. However, it was not enough to make the euro go up. The week was opened with a small downward gap (of about 10 pips), which hasn't been closed so far. The euro will hardly be behind the general trend for long, so already today we may expect growth, at least a bounce in eurusd. But all this movement is unlikely to go beyond the bounds of the narrow channel since traders will be getting ready for the second half-week, for which a whole series of CB's rate decisions and a release of US employment statistics are scheduled. Be careful as the market can be very insidious this week.

GBP/USD

The sterling doesn't pay attention to its loser neighbour and is taking advantage of the general uptrend in the market in order to fortify its positions after an unsuccessful week. The pound has started the week with growth both against the dollar and the euro. Partly it's been a result of China's statistics, partly – of overbuying observed last week, partly of technical factors – closeness to 200-day MA. Yet, the former member of the BOE's MPC, Andrew Sentance, has also made his contribution here. He has pointed out that there's nothing else for the Bank to do but toughen the policy if Britain will keep showing economic growth, which is not bad already now, taking into account growth by 0.7% in the second quarter.

USD/JPY

Strength of Asian exchanges contributes to depreciation of the yen. usdjpy has opened the week at 98.40, though the last week was closed at 98.15. Abenomics, which has been determining the economic policy just for half the year, already in the second quarter told positively on the corporate indicators. According to the published statistics, capital spending hasn't changed against the second quarter of the previous year (decline by 2% was expected) and company profits have grown by 24% in comparison with 6% a quarter before.

AUD/USD

Australia also enjoyed good news. Though here indicators of company profits can't boast as high growth as in Japan, building approvals in the country have increased impressively. In July they went up by 10.8% and the annual growth has made a bit more than 28%. It is quite a good sign of animation in the sector, which may keep the RBA from the rate cut till the end of the year. No one expects a rate cut from tomorrow's meeting of the bank, however now we may count on a more optimistic tone of the commentary.