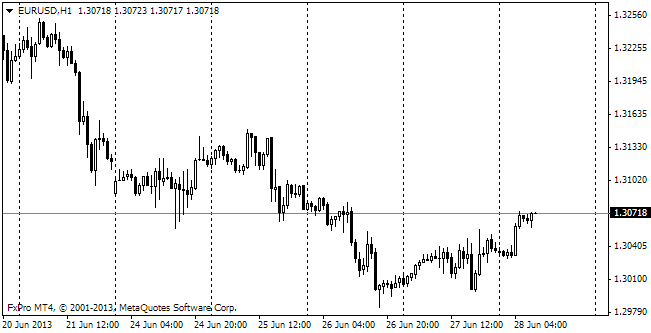

EUR/usd

Forex in general and eurusd in particular are still in the standby mode, all waiting for draghi's commentary to the decision of the ECB's governing council and for the release of the US GDP for 3Q and of unemployment claims, which can help to determine the trends of the labour market before tomorrow's payrolls. The consensus forecast of economists doesn't speak about changes in the refinancing rates and the deposit facility rate, but the community is waiting that Draghi will point out some measures to normalize liquidity in the banking sector of the region, as the latter is stalled getting ready for the ECB's stress-test. In addition, as has been indicated in the previous reviews, this step is quite possible due to the decreased inflation. The situation with liquidity can be improved in several ways, one of them is to grant new loans for a longer term or to ease collateral rules and also to stop the sterilization programme in short-term loans, issued by the ECB. Another option is to keep the key rate unchanged, in this case the deposit facility rate will become negative. It will be a kind of punishment for the banks, which ‘park' liquid assets of the ECB instead of giving loans to households and companies. Furthermore, the markets will find important the US GDP in 3Q. It will be the first estimate, so there is a high risk that it will be much different from the forecast and will arouse volatility in the markets. It is supposed that the economy could slow down to the annual rate of 1.9% (four times the quarterly growth rate) after the growth by 2.5% in 2Q. Together with the GDP we will see a release of weekly unemployment claims. They are expected to decline to 332K, which corresponds to the average rates for the last three months: in August it was approximately the same, in September – lower and in October – higher. Since Draghi's press-conference, GDP and claims are scheduled for one and the same time, the pair may well be caught up in real chaos.

GBP/USD

Britain is bringing good news. Industrial production surpassed the expectations, just like most of the stats released in the recent months. Instead of the forecasted production growth by 0.7%, it was increase by 0.9%. As a result, industrial production has grown by 2.2% over the last 12 months. As usual, together with the release of these data there was a publication of the economic growth estimate for the preceding three months by NIESR. It is reported that the economy grew by 0.7%, which shows that the high pace, gathered since April, remains such. It is not surprising that the pound feels much better than the euro. Though today's MPC publication is not expected to bring any changes, it is still feared that the BOE will tighten its policy earlier than was planned this summer.

AUD/USD

Unlike New Zealand Australia failed to impress by strong employment statistics. Employment grew by 1.1K, but completely due to the increase in part-time employees (+28.9K). Yet, the number of people employed full time fell by 27.8K, which is the sharpest decrease since June 2012. The Aussie was punished by the market for that: against the Kiwi it dropped to the three-week low, against USD – below 0.9500.

oil

The Oil price seems to have found at least the short-term bottom. The prices have stabilized around the lows since June. WTI Crude Oil (as seen from the chart) has found support at 93$ per barrel. If today and tomorrow the favourable performance of the US economy is confirmed, it is likely that we will see some recovery in the coming days.