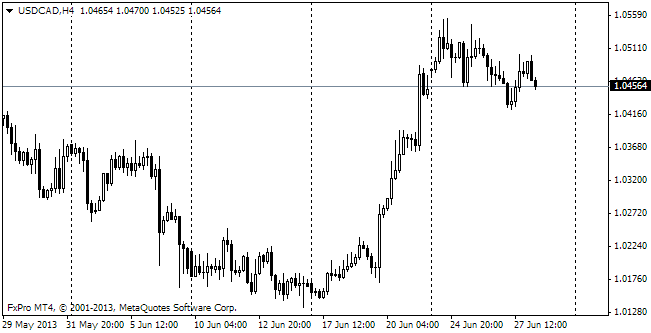

EUR/usd

fomc's officials claim now that the markets misinterpreted Bernanke's words at the press-conference a week ago. Yesterday Lockhart (doesn't vote this year) said that market participants misunderstood the intention of the Fed's head and that he would be watching closely the negative consequences for the debt market. Besides, William Dudley noted that the market reaction goes counter to the Fed's statements and expectations of the majority of FOMC's members. Powell spoke in much the same vein. The massive pressure from these four officials eventually has produced its effect. Government bond yields have slightly decreased in comparison with the trend observed for almost two months. This turn of events let eurusd consolidate around 1.30. During the Asian session today the euro managed to rise to 1.3060. So the last round of the CBs' game – ” weaken its currency” – will be headed by the Fed, which has passed over to the group attack. The US statistics released yesterday were generally neutral regarding the labour market and income/spending. In the meantime the housing market got a new portion of positive news. Pending Home Sales flew up by 6.7% in May and the growth against May 2012 made 12.5%. It means that the housing market is overheating, but it is of no fundamental importance as the FOMC has focused its attention on the labour market. And here we now see stabilization in growth of jobs and unemployment claims. The story with the derivatives of the Italian government, which in the late 90s was correcting the payment balance with the help of complex financial instruments, may have much more unpredictable consequences. As far as we remember, the troubles of Greece started in a very similar way.

GBP/USD

Forex is not fair. USD was growing all day long after the revision of the US GDP statistics and Britain, which managed to keep the GDP estimate unchanged and even showed to the markets that there was no recurring recession, nevertheless had its currency sold. The problem is in different consumer behaviour. While the USA enjoys growth both in income and spending, the British face decrease in real earnings. yet, we can't say that it is not in the interests of the BOE (which advocates job creation in the country) or of the Exchequer, to which the increased inflation helps to reduce the debt burden.

USD/JPY

In the meantime, Japan, the country with the biggest government debt among the developed countries, keeps existing amid deflation, which makes the nominal level of the debt even heavier. Against May 2012 consumer inflation has decreased by 0.3%. In a month the prices may leave the negative zone, as the leading inflation index – Tokyo prices in June – has already come out zero. The preliminary estimate of industrial production and retail sales has proved to be a bit better than expected.

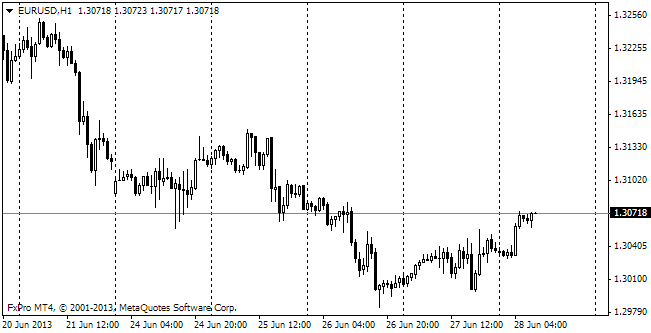

USD/CAD

The Canadian currency takes advantage of confusion of the dollar. usdcad is forming a downtrend, having set the intraday low at 1.0423 yesterday. Probably, the cautious bears are planning to reach 1.0400 before the start of the US session. However, it is better not to hurry with placing an order as later in the day the April GDP statistics will be released.