EUR/usd

Though Wall Street is close to record levels, Forex has been rather quiet over the last 24 hours. While S&P 500 yesterday closed at the highest level in history, eurusd failed to break even through the highs of Thursday night. The only achievement of bulls yesterday was that they managed to stop the correction at 1.30, taking the pair to 1.31. Well, it's not bad, taking into account that just a couple of days ago the pair was at the three-month low of 1.2750. Anyway, the market hasn't yet built the present-day tempered attitude to the stimulus rollback in the rates. In this connection we think that the dollar will keep getting weaker in the coming days, though not so swiftly as last night. It's more likely that we'll see a trend for growth by 1.5-2.0 figures over a week. It's approximately the pace of decline from the middle of June and before that – of growth from May till June. It should be mentioned here that yesterday's statistics on weekly unemployment claims only confirmed that Bernanke is right being cautious. The number of unemployment claims has grown by 20K up to 360K, which is a two-month high. But the thing is not only in this high, but in the fact that the declining trend in this indicator has stalled. So, the labour market is recovering not well enough to speak with confidence about its strength in the coming months. On the other hand, the housing market, stock exchanges and commodity markets are now having quite a good rally. It should make the committee take into account that the recovery is going unevenly, blowing up some indicators and leaving the rest without any obvious improvement. Probably, it is high time for the Fed to think about pointed regulation of the markets, like it was in China last year, to avoid a bubble in the property market. Already now we see some signs of it in the USA. For example, the index reflecting deprivation of the right of redemption has fallen to the 7.5-year low. Should it be that good or is this just “irrational exuberance”?

GBP/USD

Yesterday the pound felt a bit better than the euro and managed to hit fresh highs at the end of the day. Despite the fact that gbpusd went as high as 1.52 yesterday evening (and is close to it now), coupled with the euro, the pound remains at the upper bound of the 4-month trading range.

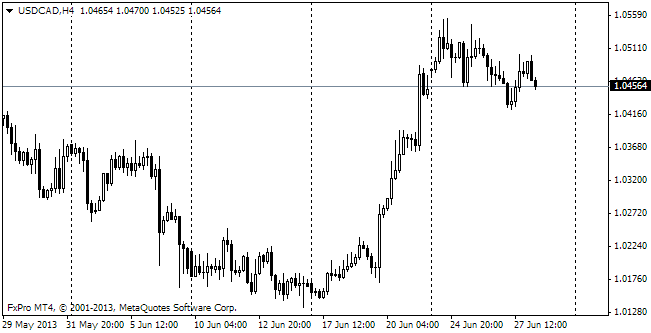

USD/CAD

The canadian dollar has felt good lately. We've often pointed at the fact that usdcad is overbought, though it's been necessary to reckon with strengthening of USD across the board. Anyhow, the Loonie has been showing an impressive performance recently, and though it's been weaker in regard to the scale, it's been unidirectional. In comparison with the high of 1.06, reported at the end of the last week, now the pair is trading at 1.0360.

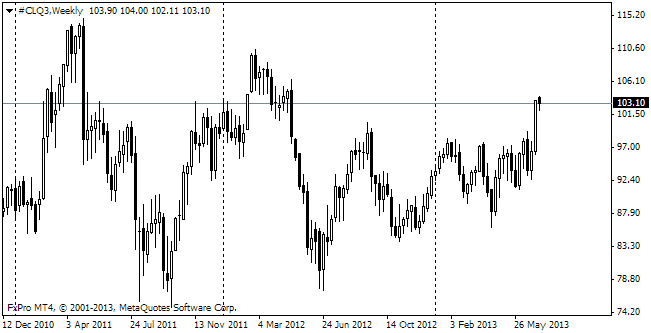

oil

In the oil market we see a more deliberate and continuous rally. Over the last three weeks the pair has managed to bounce off 92.50 and reach 107.40. But yesterday despite the festive spirit in the markets , this instrument has corrected the previous growth and is trading at 104.70. It's quite possible that we'll observe some upward impulse in the future, but now it is more appropriate to search for opportunities to sell.